While the outlook for the Brazilian feed sector this year remains uncertain, the industry has started the year with a degree of optimism. Last year saw the feed industry return to positive territory, following the contraction of 2009.

Various factors are expected to impact the Brazilian producers this over the coming years, reports the country’s feed industry association Sindiracoes. Amongst these are fears over La Nina delaying soya harvests in Brazil and Argentina, the strong appetite of China, which will become a major corn importer, and predictions of an explosion in the world’s population and consequent increase in demand for foodstuffs. Sindiracoes also points out that agricultural markets will continue to suffer instability as a result of renewed interest in commodities due to a glut in global liquidity, the expansionist monetary policy of the US and inflationary signals from China.

The outlook for the Brazilian feed industry will also depend largely on the fortunes of poultry and pig producers, which in turn in are influenced by the state of export markets, particularly as consumption levels on the home market are now close to those of developed countries.

“The risk is that the animal feed sector will continue under pressure and this could result in enough disequilibrium in the market to damage the other links in the production chain, some sooner, others later, because of static levels of meat purchases,” says Ariovaldo Zani, CEO of Sindiracoes.

He underlines that the feed sector is affected by the income and decisions of consumers and their consequent demand for meat, and that purchasing is constantly tested at retail level.

Although the outlook for 2011 looks uncertain, production of animal feed in Brazil in 2010 is thought to have been higher. This is in contrast to 2009, when total production contracted to 58.4 million tons in response to global financial crisis.

Reporting in December, Sindiracoes notes that, between January and November, output stood at 55 million tons, and that, to the year end, output is thought to have reached 61 million tons, worth some US$16 billion. In addition, 2 million tons of mineral salts were produced with a value of US$1.1 billion.

Cereal and oilseed producers suffered great losses over the first six months of the year, however, over the second half the year, the main feed ingredients, soya bran and corn, underwent a price corrections of 25% and 40%, respectively.

Broilers

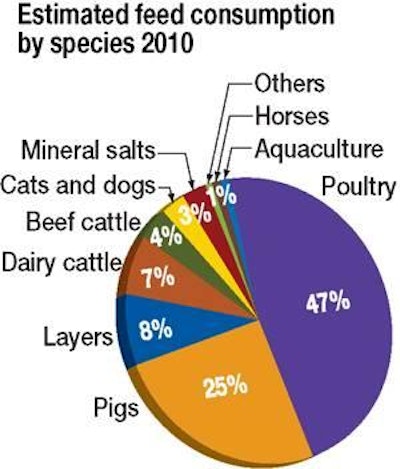

Feed for broilers and layers is the largest sector of the various categories of animal feed produced in Brazil and accounts for 47% of the total. Producers entered 2010 with optimism that the year would see continued growth in demand for poultry feed, and 2010 is thought to have ended with broiler feed output 5% higher at over 29 million tons.

Sindiracoes notes that Brazil’s over-valued currency acted as a drag on the amount of chicken exported which, to November, increased by only 6%. It continues that the profitability of the broiler industry was compromised by the cost of feed, which rose significantly. The price of chicken stayed firm, while the price of beef showed no signs of weakening. Per capita consumption for chicken meat is thought to have stood at 42 kg in 2010, while total output is estimated at 12 million tons.

Layers

Feed for laying hens is estimated to have been in excess of 4.8 million tons during 2010. Although the price of eggs recovered during the second half of the year, high prices for corn and soya reduced profitability in the sector.

Pigs

Although exports of pig meat rose by 11% over the period January to November, consumption of feed by the pig industry during 2010 reached only 15.4 million tons. Production of pig feed now accounts for 25% of the country’s feed output.

Beef cattle

2010 is thought to have compensated for the losses recorded by producers of beef cattle feed in 2009. Output is thought to have stood at a little over 2.5 million tons – an increase of 7%. From June onwards, there was an improvement in the prices of cattle for fattening, however it remained below the ideal.

Dairy cattle

Despite estimated production of feed for dairy cattle of 4.6 million tons, an increase of 5%, this was insufficient to make up for the losses that occurred in 2009. The behavior of milk prices was atypical and fell in the off-season, despite lower production and an increase in imports of dairy products. The long season resulted in the availability of low quality pasture meaning that dairy farmers made greater use of feed and concentrates; prices of which rose because of the high cost of corn and soya, further impacting the performance of the country’s dairy farmers.

Cats and dogs

At a little over 2 million tons, production of pet food in Brazil expanded by 8% last year. Rising income levels and growing consumer confidence have contributed to the strength of this sector, however, Sindiracoes notes that, despite the industry having the capacity to produce more pet food, still only 45% of the population feeds cats and dogs with manufactured pet food.

Aquaculture

Like pet food, Aquafeed still only accounts for 1% of total feed consumed in Brazil, yet is growing significantly.

Demand for aquafeed is estimated to have reached 354,000 tons last year, an increase of 15%. Feed for shrimps is thought to have expanded by 2.5% and to have reached 82 million tons. Per capita consumption of aquatic species stands at 7 kg in Brazil and aquaculture accounts for 25% of the 1.2 million tons of fish, crustaceans, mollusks and other aquatic organisms consumed each year.

Brazilian aquaculture production could reach 10 million tons annually, given the country’s favourable climate, availability of fresh water, the extent of the coastline and its millions of hectares of lakes and reservoirs. The gradual expanansion of aquaculture should help to compensate for the decline in sea stocks, notes Sindiracoes.