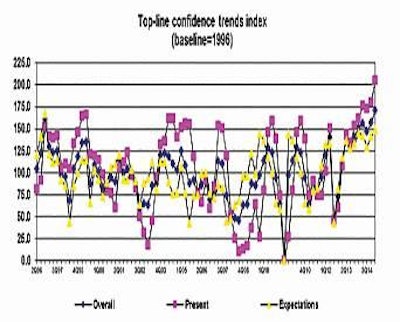

industry’s confidence in present condition and future conditions in recent quarters.

Optimism about the U.S. poultry industry's current economic conditions rose in the WATT-Rennier Poultry Confidence Index for the first quarter of 2015.

Many attendees left the successful 2015 International Production and Processing Expo (IPPE) in Atlanta feeling highly optimistic about poultry market conditions, business opportunities and profitability. The first-quarter 2015 Poultry Confidence Index confirmed this positive attitude.

The Overall Index now stands at a record 171.1 (1996 = baseline), up from 157.0 in the fourth quarter of 2014. The Present Situation rose to 204.7 in Q1 2015 from 180.3 in Q4 2014 – its highest level ever – while the Expectations Index increased to 148.7 in Q1 2015 from 141.4 in Q4 2014.

As noted, two of the three primary indices reached new highs, as did three of the five sub-indices: Present Conditions, Present Opportunities and Future Opportunities. The former even surpassed the 200-point mark. Furthermore, the combined values of the five sub-indices – as well as the broiler sub-index – were the highest ever recorded.

The general economy paralleled this record-setting performance. While sluggish for several years, the Consumer Confidence Index rose sharply in the beginning of 2015 and reached its highest level since August 2007. It seems the economy is starting to gain some steam!

Nearly all key economic factors for the poultry industry – demand, supply, competitive proteins, cost inputs and exports – are trending in a positive direction contributing to an unprecedented period of optimism that started in the middle of 2012.

Even job and business opportunities – which had risen but lagged behind the other indices – took a decidedly positive turn. Excitement about expansion plans – both in the form of increased broiler placements and capital improvements – boosted opportunistic perceptions to record levels. Announcements by several poultry integrators of pending and future expansion plans contributed to this trend.

How long will this optimism last? Nearly two-thirds of our respondents thought this optimism would subside within the next year. They felt profitability would decline primarily due to supply and demand issues, and secondarily, to rising costs.