World meat production growth in 2014 is expected to be modest, growing 1.1 percent from the nearly 308.5 million metric tons produced in 2013 or an increase of 3.3 million metric tons. Much of the demand for the nearly 311.8 million metric tons of all meats produced in 2014 continues to come from developing countries with rising populations.

According to the latest Food and Agriculture Organization (FAO) and Organization for Economic Co-operation and Development (OECD) Agricultural Outlook publication, growth in poultry meat production over the past year has been the slowest in the last 20 years, at a rate of 0.5 percent. The slow growth can be attributed to the impact of high feed prices during the first half of the year, as well as falling production in China due to an outbreak of H7N9 avian influenza. An increase of 1.6 percent over 2013 will result in nearly 108.7 million metric tons of poultry meat being produced around the world in 2014. FAO estimates that poultry inventory globally stood at 22.6 billion in 2013, and has experienced a growth rate of 2.8 percent per year since 1995. During the outlook period, the poultry inventory growth rate is expected to slow to 2.2 percent to 2023.

U.S. leads growth in output

Growth in output will be greatest in developed countries, led by the U.S., which is anticipated to expand production by 1.8 percent to a record nearly 20.6 million metric tons. China, currently the second largest producer, is projected to see production fall by 1.7 percent in 2014 as it continues to suffer from the effects of 2013’s bird flu. Other major producers around the world, such as the European Union, Brazil and Mexico, are all projected to see gains, with the most notable growth coming from Russia (8 percent) and India (6 percent).

Production growth will also be matched with growth in consumption, as changing demand preferences will make poultry the largest meat sector by 2020. In the base period 2011-13, poultry meat consumption around the world per capita averaged nearly 13.2 kg per person per year. Changing diets in countries like India, as well as poultry’s lower cost relative to other meats and rising incomes, have aided consumption growth. As the cheapest meat, consumers often enter the market by purchasing poultry products, consuming greater quantities as their incomes rise.

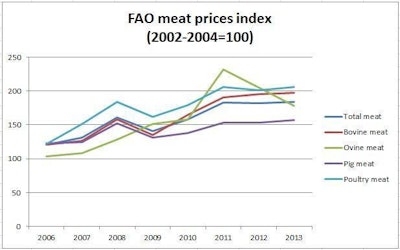

FAO’s Meat Price Index, a measure of global meat prices, has remained at historically high levels since 2011 and currently remains about 90 percent higher than a decade ago. Feed prices, however, fell in 2013, providing some relief for poultry producers. In the United States, a major player, prices for chicken and eggs have started to come down from elevated levels seen at the end of 2013 and beginning of 2014.

Poultry accounts for the most growth in meat trade

With lower feed costs, rising consumption and avian influenza challenges in Asia, poultry will account for the most growth and comprise 43 percent of the total 31.3 million metric tons of meat that is traded in 2014. The world imported nearly 12.8 million metric tons of poultry meat in 2013 and will have imported nearly 13.2 million metric tons by the end of 2014. Developing countries remain the major traders, importing 9.2 million metric tons in 2013 and 9.5 million metric tons in 2014 – nearly three times more poultry meat than developed countries. Exports of poultry meat globally stood at nearly 13.2 million metric tons in 2013 and are forecast to reach 13.5 million metric tons in 2014.