This article appears in the December issue of Poultry International. View all of the articles in the digital edition of this magazine.

The United States is home to one of the largest national layer flocks in the world -- 288 million laying hens -- and also to some of the world’s biggest egg producers.

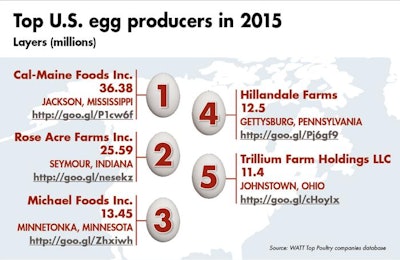

At least five companies have more than 10 million laying hens, while 17 are thought to have more than 5 million. Sixty-three producers are believed to have more than 1 million birds.

Lower down the scale, there are thought to be 186 egg producers with more than 1 million birds at lay, says industry body United Egg Producers (UEP). At this level, consolidation in the industry becomes particularly evident. In 1994, there were at least 350 producers with laying flocks of this size.

But consolidation is not the only way in which U.S. egg producers are experiencing change; egg companies across the board are having to adapt to growing demand for cage-free eggs.

Over the past 12 months, retailers and foodservice outlets – led by companies including McDonald’s and Wal-Mart Stores – have committed to sell only cage-free eggs by 2025 or a similar date. UEP estimates that more than 190 million birds will need to be cage-free by 2025 to meet cage-free demand.

The U.S. egg industry produced 83 billion eggs last year, making it the world’s second largest egg producer, yet just five companies alone account for one-third of U.S. egg production:

1. Cal-Maine Foods Inc.

With almost 36.4 million laying hens, Cal-Maine Foods Inc. is the largest egg producer in the U.S. and in the world.

The company had a record 2016, with net sales topping $1.9 billion and net income of $316 million. Financial 2017, however, has started poorly for Cal-Maine with sales lower and a net loss in the first quarter.

The company cites a more challenging market for this decline, with egg prices much lower than in the previous fiscal year.

Despite these difficulties, Cal-Maine continues to expand and, in August, signed a letter of intent to purchase Foodonics International, adding about 3 million layers to its flock.

Being the largest egg producer in the U.S. has not made Cal-Maine immune to the growing demand for cage free eggs, and the company is involved in various capital projects to increase cage-free capacity. In early 2017, for example, its new 3 million-hen cage-free farm in Bogota, Texas, a joint venture with Rose Acre Farms Inc., is expected to reach full capacity.

Specialty eggs, which include cage-free eggs, make up almost 23 percent of Cal-Maine’s sales.

2. Rose Acre Farms Inc.

Rose Acre Farms Inc. is family owned and, with 35.6 million laying hens, is the second largest egg producer in the U.S. Its affiliated and subsidiary corporations include Rose Acre Farms International, Marshall Egg Products, Johnson County Egg Farm and NEPCO Egg of Georgia.

In addition to the recent joint venture with Cal-Maine Foods, Rose Acre Farms was expected to open an $80 million cage-free egg farm able to house 3 million layers in La Paz County, Arizona, in fall 2016.

3. Michael Foods Inc.

Michael Foods, the world’s largest supplier of egg products, has the third largest flock of laying hens in the U.S., numbering 13.5 million hens.

Since 2014, Michael Foods has been owned by consumer packaged goods holding company Post Holdings, and will be combined with Willamette Egg Farms – the country's 30th largest egg producer, which has also entered Post’s portfolio. In September, Post announced that it would acquire National Pasteurized Eggs, with completion expected in early 2017.

Michael Foods was deeply affected by the U.S. avian influenza outbreak in 2014-15, with approximately 35 percent of its egg volume commitments affected, resulting in losses and employee layoffs.

In late 2015, Post announced that it too would move to cage-free production and, in August, announced plans to convert a farm in Bloomfield, Nebraska. Starting next year, 32 layer barns will be replaced with 12 cage-free houses.

4. Hillandale Farms

With 12.5 million hens, Hillandale Farms has production facilities in the Northeast, Midwest and Southeast of the U.S. and supplies retailers and distributors throughout the eastern U.S.

In 2015, the company completed the purchase of three egg farms in the eastern U.S. from Moark L.L.C.

This year, Hillandale announced plans to change from conventional to cage-free laying systems. Hillandale is building new cage-free layer houses in Ohio and Connecticut and is placing cage-free systems in its New England and Ohio pullet operations, expected to come into operation in 2017.

5. Trillium Farm Holdings L.L.C.

With 11.4 million laying hens, Trillium Farm Holdings L.L.C. is the fifth largest egg producer in the U.S.

This year, a new holding company, Versova, was set up to manage the business operations of Trillium Farms and Centrum Valley Farms, the country's 16th largest egg producer and owner of approximately 6.1 million laying hens. The two companies will still exist independently.

Like their larger competitors, both companies are moving to cage-free housing and are building new facilities to meet demand.

To access the World’s Top Poultry Companies database in full, go to:

www.WATTAgNet.com/directories/80.html