It's trite, but oh so true the world is getting smaller. Whether one goes to Gainesville, Ga., to the countryside of Thailand, or the vast agricultural areas of Eastern Europe, one is likely to see more similarities in production and processing practices of broilers than differences.

Consolidation of suppliers of breeding stock, production equipment and processing equipment has made international trade a necessity. And with that consolidation, the efficiencies of improved genetics, feed formulation and processing technologies have leveled the playing field such that the American broiler industry can produce chicken economically. But the commonality of production and processing practices has broadened the field of potential producers (and competitors) of poultry meat for the world marketplace.

Race for dominance

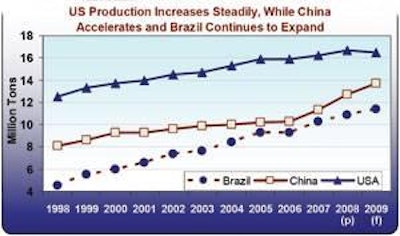

The Foreign Agricultural Service of the USDA published in October its "Livestock and Poultry: World Markets and Trade." Several of the trends point to an exciting race for poultry dominance in the world. The U.S. industry has grown in the last decade, but that production growth is leveling off. On the other hand, China and Brazil are showing steady growth in production, so much so that the U.S. position as the top broiler producer in the world is about to come to a close.

So, how do the domestic poultry companies grow? They grow by consolidation and by gaining footholds abroad in emerging markets. Pilgrim's Pride has a long history in Mexico as has Tyson. Tyson has recently announced its intentions to invest in Brazil and increase investment in China.

Where do poultry companies outside the U.S. look for growth? Watch out; The U.S. may be an attractive market for purchasing domestic facilities. Although the C-P experiment did not succeed several years ago, it will not surprise anyone to see Brazilian firms look to the U.S. to gain a foothold in domestic markets and as avenues for access to U.S. export markets.

This brings me to the International Poultry Expo being held January 28-30, in Atlanta, Ga. The show has evolved in to a major networking route for both domestic and international poultry leaders. In 2008, close to 4,000 international visitors from over 100 countries walked the exhibit floor of close to one-third of a million square feet of exhibits featuring 895 exhibitors. Out of these, over 1,700 were from Latin America/Caribbean and over 550 from Asia-Pacific.

The 2009 show will be even bigger than 2008, and while margins have not been as good in 2008 as the previous year, the break in commodity prices plus the efforts of industry to bring supply in line with demand should provide reasons for optimism for 2009. The addition of a number of new educational programs should make the last week in January a very rewarding and productive week.

Expo highlights

Special programs this year supplement the traditional U.S. Poultry & Egg Association and AFIA educational programs. These include:

Pet Food Regulatory and Technical Conference, January 27-28.

Animal Agriculture Environmental Sustainability Summit, January 27-28, co-sponsored by USPOULTRY, NCC, NTF, UEP, AFIA, National Pork Producers Council, Animal Ag Alliance and the National Renderers Association.

Impact of alternative ingredients on poultry feed cost and quality, January 29, sponsored by WATT.

Poultry Market Intelligence Forum, January 30, co-sponsored by USPOULTRY and the NPFDA.

See you in January.