Growth in European broiler meat production has slowed dramatically this year, despite rising demand from European consumers.

Latest forecasts released by the European Commission suggest that production of poultry meat by the European Union’s Member States will reach 14.48 million tons this year, an increase of only 0.7 percent, and significantly lower than the 4.4 percent increase recorded in 2016.

This slowing growth can be largely attributed to the impact of avian influenza. While most Member States have been affected by the virus to varying degrees, two of the region’s largest producers, France and Germany, have been particularly badly hit.

France, for example, also Europe’s largest duck producer, organized a cull of more than 1 million ducks and geese at the start of the year to help control spread of the virus.

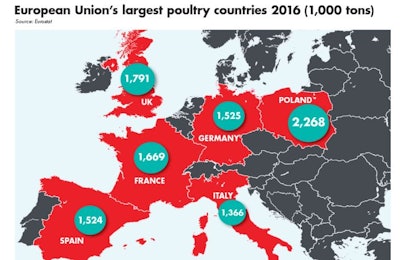

Three of the leading poultry producers in the region – France, Germany and Italy – saw the number of birds slaughtered over the first quarter down, while Poland, Spain and the United Kingdom saw slaughter numbers increase, the latter by 10.5 percent.

Although the number of avian influenza outbreaks has now declined, as of mid-July outbreaks were ongoing in six of the EU’s member states.

Poultry exports, imports lower

Europe is the world’s third largest exporter of poultry meat by volume and, long term, exports are expected to continue upwards. However, the first half of the year has seen growth in exports go into reverse.

Several markets have closed, either partially or in their entirety, to European exports. Exports contracted by almost 3 percent to 626,000 tons over the first five months of this year in comparison to the same period in 2016. There may be some relief for Europe’s producers as 2017 progresses and export markets reopen.

However, while the overall total was slightly lower, not all export destinations turned negative. Among the EU’s main exports markets, sales to Ghana rose by more than 48 percent, while those to Ukraine were up by more than 43 percent. Despite these successes, significant double-digit declines were recorded in several important markets.

While overseas sales may have proved difficult, the home market is offering some solace. Per capita consumption is forecast to increase slightly this year to 23.81 kg, driven not only by consumers looking to eat more healthily, but also by constrained consumer circumstances. Prices midyear are also slightly higher.

Import volumes over the first five months of 2017 were also down, by almost 8 percent, but again, performance was mixed across the EU’s principal suppliers with imports from Chile down by almost 13 percent while those from Ukraine were almost 71 percent higher.