The slowdown in the global economy has hit developed and developing countries alike, impacting adversely on demand, output and trade in poultry meat and eggs.

In developed economies, where income changes have less of an impact on purchases of eggs than on those of meat, the egg sector, at least, is expected to remain relatively unaffected, although some countries have reported a decline in demand for the more expensive specialty eggs.

It is possible that sales of eggs in developed economies might actually benefit in the current economic climate, as customers decide they cannot afford more expensive meat. Overall, however, in developing economies, where changes in real income play a more important role in food purchase decisions, the outlook for both poultry meat and eggs is depressed.

The poultry industries are currently benefiting from lower feed and energy costs compared with last year. These benefits are expected to be short-lived, nevertheless, the good news is that growth in the global economy is expected to return to around 3% in 2010.

Taking a longer-term view, the outlook for the poultry industries is positive. Although the rate of increase in the global population is slowing, it is still growing. By 2050, the global population is expected to stand at some 9 billion. This growing population, together with a recovery in real incomes, will result in increased demand for poultry and eggs in the years ahead.

Meat

This year, some countries will experience a cutback in poultry meat output. For example, broiler production in the USA - the world’s largest producer - is expected to contract by around 650,000 tons, or almost 4%. Nevertheless, the USDA’s forecast for world broiler output is up a shade on last year at 71.4 million tons. The FAO expects global poultry meat production to show a 1% increase at 94.7 million tons.

This contrast with annual turkey meat production is currently static, having shown virtually no significant increase since 2004, and stands at around 5.1 million tons per annum.

World trade in poultry meat will fall by 3% this year to a little over 10 million tons, forecasts the FAO. However, according to the USDA, trade in broiler meat (excluding paws) will slump by more than 500,000 tons, or 6%, primarily as a result of smaller purchases by Russia and Japan. Russia looks likely to import less than 1 million tons compared with 1.23 million tons four years ago, and observers in that country are confident that domestic production will continue to expand, leading to a further contraction in imports.

While the recession is hitting demand for meat, in developed economies this could actually benefit chicken sales, as consumers trade down their meat purchases. However, in developing countries, where the correlation between incomes and meat consumption is more pronounced, some consumers are likely to turn away from meat to vegetarian diets, leading to a cut in chicken uptake.

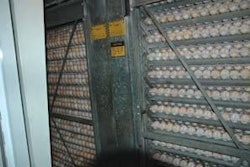

Eggs

Worldwide layer numbers are currently thought to be some 6,200 million, up from 34,826 million a decade ago.

Shell egg production (including hatching eggs) this year could well top 65 million tons. While expansion has averaged 3% a year over the decade to 2007, the rate of growth has more recently fallen towards 2.5%. At least one forecaster believes that this figure will fall below 2% from now until 2015, when global output is expected to amount to around 71 million tons.

Without doubt, the most exciting aspect of the egg trade is the way in which exports of dried egg have more than trebled from less than 18,000 tons in 1990 to more than 57,000 tons in 2006.

Europe continues to be the leading exporting region, with the USA the leading country, shipping nearly 10,000 in 2006 as against 4,200 tons in 2000. The second largest exporter is India. Shipments from the country have rocketed to almost 9,000 tons, having stood at only less than 1,000 tons at the start of the decade.

Although exports of shell eggs rose by almost 10% in 2006 to reach 1.22 million tons, this still represented less than 2% of global production. In Asia, three countries dominate the shell egg export market, China, India and Malaysia, of which India is the most aggressive seller, having expanded shipments form 11,000 tons to almost 50,000 tons over the six years to 2006.

The latest International Egg Commission estimates for 2007 have been included in this year’s Executive Guide and these indicate that China, where average egg consumption is thought to have reached 249, has recently taken over from Mexico (345) as the leading egg consumer in terms of the number eaten per person.

While total egg consumption and the uptake on a per person basis will continue to grow long-term virtually everywhere, in developing countries the gains will be via the purchase of shell eggs. In many developing countries, the rise will often reflect an increase in eggs eaten as egg products which, in some instances, will be at the expense of the uptake in shell eggs.

In the USA, the proportion of eggs broken for further processing and consumed in product form now exceeds 31% of total production, and some industry observers consider that this figure will rise to 50% by 2020.

Last November, Californians voted to effectively ban conventional layer cages. This ban is expected to prove disastrous for egg producers in the USA’s fifth-largest egg-producing state, home to some 20 million birds.

As a result of the ban, egg production in California is expected to contract dramatically, while egg imports, which currently account for around one third of supplies, will increase. Almost certainly, the animal protection organization the Humane Society of the United States, will now target other states – a concern for all US egg producers.