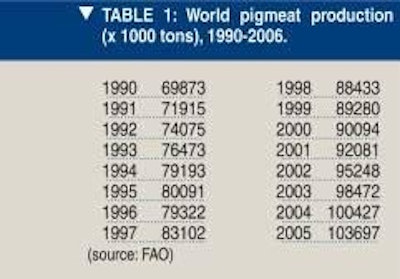

Latest estimates from FAO, the food/agriculture agency of the United Nations, suggest that a record 103.7 million metric tons of pigmeat were produced worldwide in 2005. This would represent an annual increase of almost 3.27 million tons or approximately 3.25%. Global pork production last year was 15% more than in 2000 and over 48% above the volume recorded for 1990 (see Table 1).

Banner years for world pigmeat output are confirmed by the Table 1 data, which also illustrate how the rate of expansion has progressed. They show that production topped 70 million tons for the first time in 1991, passed the 80 million tons mark in 1995, broke through the 90 million tons barrier in the year 2000 and hit 100 million tons in 2004.

Table 2 analyses how the world's regions have shared global output since 2000. To judge from these rounded percentages, the story of the decade so far has been of a further transfer of production from Europe to the Asian area. The regional shares held by the countries of North America, Latin America and Africa have hardly changed over this time.

Previous annual reports in the Pig International directory issue have examined the line-up of the Top 10 countries for size of yearly pork production. We have extended the list for this report, now giving our idea of the places that were the Top 20 producers of pork in 2005.

One important change of ranking has occurred since the Top 10 list published in 2005. At that time we showed Vietnam in 10th position, but the Vietnamese production data for last year move the country up to Number 7 ahead of Poland, Canada and Denmark. Vietnam's output has apparently risen by 56% since 2000 and by 22.5% in the last 3 years alone. Poland has moved back ahead of Canada after suffering a downturn in 2004.

Ten out of the 20 countries in Table 3 saw their production increase between 2004 and 2005. In most other cases the reductions were relatively small. The exception was the Korean Republic (South Korea), considered to have lost almost 100 000 tons from its 2004 volume.

Asian hot-spots in the Table are clearly China and Vietnam. Latin America's biggest players, Brazil and Mexico, continue to show growth. In North America, US production has grown much more than that of Canada since 2000. Few former EU-15 members in Europe have shown significant recent increases in output, but new member state Poland seems to have recovered its level of pork production after joining the European Union.