Nigeria, sub-Saharan Africa’s second biggest economy and its most populous country, has been best known in recent years for its oil and gas industries which have made up around 97 percent of the country’s revenues. Recently, the country has been hitting the feed media headlines as the industry’s big players, notably Nutreco and Cargill, invest heavily in the region.

With a largely uncultivated land area that is about twice the size of California, Nigeria seems to be realizing that its population of 180 million cannot eat oil and gas and that, in addition, it could play a considerable part in feeding the world’s growing population. For the poultry industry, however, a number of practices need to change if this role is to be fully embraced.

The realization is something of a 360-degree turn for the country. In the 1960s, 60 percent of Nigeria’s GDP came from agriculture - and the poultry industry had strong government support.

By the 1980s, however, import bans had negatively impacted the sector. Subsequently, factors including disease, high veterinary costs and a lack of breeders then impacted production until the late 1990s.

However, change is taking place. Gradually, local and UN/World Bank funding for projects such as the establishment of a designated avian influenza laboratory have helped improve the situation. Local lending for agricultural projects, including poultry production, is also predicted to rise to 10 percent in 2015, up from as little as 0.7 percent in 2011.

Latent potential

There is certainly room for improvement. As recently as 2012, a mere 22 percent of Nigeria’s national GDP was estimated to come from agriculture - and only one-third of that from livestock production. The forecasts look promising, with percentages set to double year on year, giving a total worth for agriculture of US$263 billion by 2030.

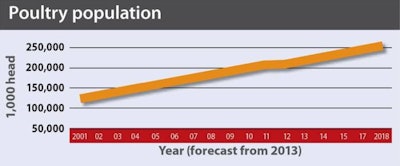

The efficiency of poultry production in the country could be improved. The country produces 290 million tons of poultry meat from an estimated poultry flock of 205 million - the largest in Africa. This is less than one-fifth of the production in South Africa, which produces 1,486 million tons with a flock of only 160 million birds. Part of the issue is that only 25 percent of production operations are run on a large commercial scale, which is primarily due to the lack of past investment.

While poultry meat may have been viewed as a luxury food in the past, there is now growing local demand for the meat, which is expected to increase by more than 33 percent over the next 10 years, particularly in the north of the country where the majority of the population is Muslim.

As far as egg production is concerned, the country is the largest producer in Africa. However, local supply outstrips demand causing downward pressure on pricing and export is not easy. Addressing infrastructure issues and safety concerns would improve exports of poultry meat and eggs.

Feed costs – one of the main challenges

Corruption, unpredictable weather – for example the floods that destroyed 1.9 million hectares of farmland in 2012, disease and the increasing state of insecurity caused by Boko Haram in the major grain-producing region in northern Nigeria are all ongoing challenges and will need to be addressed if the industry is to truly flourish.

However, as feed costs account for approximately 80 percent of production costs, the primary factor holding back growth of the country’s poultry industry is the high cost of common feed grains such as soybean meal and maize.

While coarse grain prices have remained stable or declined, the price of maize, which makes up around one-quarter of the average Nigerian poultry feed formulation, has continued to rise as demand outstrips seasonal supply and grain imports are restricted.

This is not a new phenomenon. After being banned from import from 2005 to 2008, maize tripled in price from 2007 to 2008 due to poor domestic harvests. Prices rose again during the 2012 floods and, despite a good harvest, went up by approximately 15 percent to more than US$500 per ton by March 2013, with another 50 percent rise between November 2013 and January 2014. Although corn is the preferred energy source and accounts for about 60 percent of compound feed, to offset high corn prices and difficulties with importing corn, feed millers are increasingly using imported wheat in feed formulations.

Similarly, locally produced soybean meal, which is the main source of protein, surged to a high of US$775 per ton in 2011, up from US$485 in 2010. Unsurprisingly, lower quality substitutes such as peanut cake, cottonseed and palm kernel meal are starting to be favored by poultry producers to reduce this cost.

Enzymes – key for Nigerian poultry production?

One of the key strategies that can be employed by Nigerian poultry producers to improve production efficiencies and reduce costs lies in embracing advances in feed enzyme biotechnology. More than 2,500 independent tests conducted in broilers show that feed enzymes such as phytase, xylanase, amylase and protease can improve profitability. Optimized enzyme combinations – such as xylanase, amalyse and protease - have been shown to minimize raw material variability and viscosity from more complex diets containing wheat, sorghum and lower quality protein sources, and significantly improve digestibility and performance.

Trials have shown that combining these multi-enzymes with the right amount of phytase can achieve consistent feed quality and body weight/calorie conversion improvements to save between US$80,000 to US$100,000 per million birds (based on 2013 feed costs). This level of saving in a country such as Nigeria, where feed costs are very high, makes inclusion of such combinations in poultry diets particularly attractive.

Bird liveability has also been a major concern in Nigeria. As production becomes increasingly commercial, maximizing the digestibility of substrates in the gut is also growing in importance. This not only ensures that more nutrients are available to improve performance growth, but also means that there is less undigested material that could act as substrate for pathogenic bacteria.

This is particularly the case for undigested protein, suggested as a factor linked to the establishment of Clostridium perfringens, coccidiosis, and associated necrotic enteritis episodes in chickens. Combinations of Bacillus probiotic and xylanase, amylase and protease enzymes in a specific necrotic enteritis challenge model showed net benefits of 14 percent in relative cost per kg live weight gain versus the challenged control at current feed prices, illustrating the strong economic value that this sort of combination could offer Nigerian producers.

Less variable future for Nigerian poultry industry

As Nigeria strives to improve the performance and uniformity of its flocks and their liveability, the use of multi-enzymes such as carbohydrase, protease and phytase will become increasingly important to improve the cost and quality of locally produced Nigerian chicken, reducing the need for imported product and ensuring that local poultry producers make a healthy profit.