Total meat trade, of which poultry meat will comprise nearly 45 percent, will remain around 10 percent of production, based on FAO projections. At the end of 2014, poultry meat trade volume will have increased an estimated 2.4 percent, which is slower than the growth pace seen over the past decade, attributable to rising production among exporting countries and poultry’s competitive price relative to other meats.

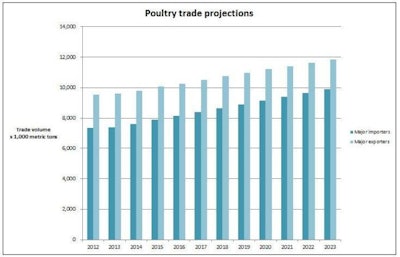

FAO estimates a total of more than 16 million metric tons of poultry meat will be exported worldwide in 2023, compared to the nearly 12 million metric tons averaged over the period of 2011-13; global imports of poultry meat will total nearly 15.9 million metric tons in 2023 up from 12 million metric tons averaged from 2011-13. Developing countries will largely continue to dominate trade around the world, accounting for 2.74 percent of export growth over the period from 2014-23. Slower growth rates can be seen throughout the world over the next decade compared to the previous decade from 2004-13. Notably, average export growth of 3.6 percent is forecast for Europe over the period to 2023; here, recent expansion of Ukraine’s poultry sector will help to contribute to export volume, depending on the outcome of continued turmoil in the region.

Outlook for exports

Exports over the outlook period will originate mainly from South America and North America, where the number one and two poultry meat exporting countries, respectively, Brazil and the U.S., lie. In 2015, major exporting countries will trade a total of 10 million metric tons of poultry meat, of which an estimated 3.76 million metric tons will hail from Brazil and nearly 3.69 million metric tons will come from the U.S. Of the poultry meat exported from the U.S., gains can be expected for both broilers and turkeys. In addition, USDA forecasts egg and egg product exports of 338 million dozen in 2014 and a slight decrease in 2015 to 320 million dozen. Thailand, a supplier of boneless poultry cuts to the EU and Japan, is projected to record strong export growth from 580,000 metric tons in 2014 to 629,000 metric tons in 2015.

Outlook for imports

In total, world poultry meat imports averaged about 12 million metric tons over the period from 2011-13. Growth in imports is expected to continue worldwide over the outlook period, standing at 12.25 million metric tons in 2014 and 12.88 million metric tons in 2015, growing to 15.86 million metric tons by 2023. The most significant import demand growth over the next decade can be seen coming out of Asia and Africa. Mexico, too, is expected to increase its imports of poultry meat over the coming years, sustained by growing demand. On the contrary, Russia, historically a major importer of poultry products from the EU, is expected to decrease its exports by 2 percent to levels less than half of what they were a decade ago. The increased domestic production that will allow Russia to decrease its imports will stall import demand growth for poultry meat in the EU, as a result. However, the egg trade balance in the EU will continue to remain positive in 2014, with the region’s trade volume up slightly for the first six months of 2014 compared to 2013. Over this period in 2014, EU countries exported 126,000 million metric tons of eggs (not including those for hatching) and imported just 7,000 metric tons.