The Malaysian poultry industry has undergone a transformation over the last decade. Chicken production has increased, and small-scale producers have been largely replaced by integrators.

The sector now operates more efficiently, and since the 1990s, the country has been self-sufficient in broiler meat. In 2011, Malaysia produced 1.2 million metric tons of poultry meat.

However, according to a report by the Malaysia Competition Commission, there is still room for significant modernization in the sector both through greater use of automation at the production level and through processing a greater number of the birds.

Labor for the agricultural sector in Malaysia has become increasingly hard to find, and this includes for poultry production. At the other end of the supply chain, poultry meat is still subject to some price controls, and this is thought to affect producers the most.

Poultry meat sale controls

Of all the livestock products sold in Peninsula Malaysia, broiler meat is the main type consumed as it is free from cultural and religious restrictions. Poultry meat purchases are primarily made at wet markets.

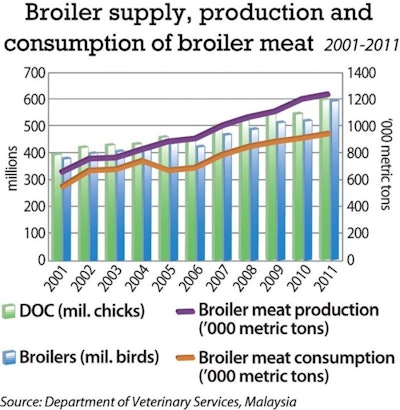

Poultry meat production reached 1.2 million metric tons in 2011, up from 682,000 metric tons in 2001, reports the Department of Veterinary Services. Consumption over the period rose from 577,900 metric tons to 918,000 metric tons.

Yet despite there being a plentiful supply of chicken meat in Malaysia, there is not a completely free market for chickens -- poultry is classified as a "controlled item" by the government.

Prior to June 2008, the government would determine the retail price for broilers. Although this system is no longer in operation, the government is able to impose a maximum retail price for a two-week period before and after festivals.

The price controls are designed to facilitate local celebrations; however, such controls distort supply and demand. The negative impact is thought to hit chicken producers harder than chicken retailers, as the latter tend pass on falling market rates more quickly to producers than they do to consumers.

Yet even with this limited government imposed price control, volatility has not been removed from the market or resulted in price stability. The price of chicken meat has gradually risen, despite production becoming more efficient.

Prices overall have been on an upward trend, but there has been marked volatility over the last few years. In 2009, the average price achieved by producers was RM4.12 (US$1.20), while in 2011 this had risen to RM4.87. However, volatility at the retail level has been greater, and overall prices have been higher than the Consumer Price Index.

Some 65-70 percent of broilers are sold directly to wholesalers, while the remainder is sent to processing plants, which supply restaurants, hypermarkets, wholesalers and retailers. As of late 2011, there were 317 licensed wholesalers and 1,240 licensed retailers in the peninsula.

Malaysia's changing poultry farming structure

There is a lack of clear data on farm ownership in the Malaysian poultry industry.

For example, 292 broiler farming establishments were officially registered as companies in 2008. Yet, a subsequent survey of the sector in 2010 revealed 2,978 broiler farms.

The Malaysia Competition Commission attributes this significant difference to two possible factors: It believes that a number of independent farmers may have failed to register as businesses and that many of Malaysia's chicken farms are owned and operated by a much smaller number of integrated companies.

More than 50 percent of Peninsula Malaysia's broiler farms are located in the states of Jahor, Perak and Terngganu, and they account for some 55 percent of the country's broiler population.

Interconnected industry

Smaller scale, independent and owner-run activities that once made up broiler production have been replaced by a system of contract and outright ownership by integrators, and it is now common in Malaysia for broiler chickens to be raised by growers contracted by independent integrators.

According to latest available data, there are now 10 vertically integrated broiler businesses in Malaysia, compared to five in the early 2000s. The businesses own their own hatcheries, processing plants and feed mills, and supply day-old chicks internally and also to small independent producers.

According to data from the Department of Veterinary Services, there are four grandparent stock farm operators in Malaysia involved in the production of day-old chicks for their own parent stock farms as well as for other parent stock farmers. Malaysia has 92 parent stock farms, operated by 24 parent stock companies. Ten of these are owned by integrators.

Annual parent stock has almost doubled from about 8.86 million birds in 2006 to reach 16.96 million birds in 2010. The parent stock of free-range chickens fell significantly from about 236,000 birds in 2006 to about 48,000 in 2009. However, there was a slight increase in 2010 to 64,000 birds.

There are 53 hatcheries in Peninsula Malaysia, largely concentrated in Johor. Some 58 percent of Peninsula Malaysia's hatcheries are owned by integrators.

Day-old chick production stood at 653.1 million in 2011, up from 377.8 million in 1996. Growth was strongest in the six years to 2011, standing at 6 percent. Prior to this, the average annual rate of increase was 2.3 percent.

Rising poultry production costs

Like other poultry producers around the world, Malaysia's broiler industry has been hit by rising feed costs. In addition, the sector has had to cope with price inflation for day-old chicks.

The overall price of day-old chicks rose by 45 percent between January 2007 and July 2012. For example, in 2011, the average price of day-old chicks was RM1.76 -- 21 percent higher than in 2010. Yet this increase pales in comparison with the increase in feed prices, which rose by 80 percent between 2007 and 2012.

A significant proportion of the inputs needed by Malaysia's broiler industry is imported. For example, the country imports superior genetics, feed ingredients, feed additives and vaccines. The only locally produced feed ingredients of any significance are crude palm oil and rice brand, and these are only used in very low levels in the formulation of feed.

However, feed and day-old chick costs are not the only difficulties currently confronting Malaysia's broiler producers.

As the Malaysian economy has modernized, working in agriculture has become less attractive to the local population and broiler producers have become reliant on foreign workers. Yet, even foreign workers are now proving difficult to hire and retain.

However, this difficulty is expected to have longer-term benefits, as producers will have few alternatives to introducing greater mechanization, which would in turn raise efficiency.