Beef, as produced in the USA, has a feed conversion of about four to one; pork, three to one; and chicken, two to one. These biological facts should give chicken a significant advantage given current high grain prices.

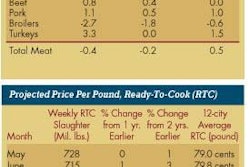

Higher competing meat prices are on the way but will take years to develop. There is a considerable time lag between higher grain prices and higher beef and pork prices. When prices eventually readjust, consumers will be surprised at how high meat prices will climb. The average U.S. retail price of beef, for example, now $4 per pound, will rise to at least $5 per pound. Pork will rise from $2.80 per pound to at least $3.50 per pound. Higher prices for competing meats will, of course, be beneficial to the poultry industry.

Time Lag

The time lag is caused by both livestock biology and the organization of the meat industry. Cattle live a lot longer than chickens. More importantly, the U.S. beef industry is divided into three parts cow-calf operations that produce the feeder cattle; feedlots that fatten the cattle; and slaughter houses. The non-integrated nature of the industry delays the adjustment to higher prices as the three groups take turns incurring losses until the entire industry eventually adjusts to higher costs and passes those costs on to consumers.

In the first two years after feed prices rise substantially, there is likely to be little change in the retail price of beef. Feedlots initially reduce the price paid for feeder cattle in order to remain profitable. Cow-calf operations respond by beginning to reduce their herd. In the second year, larger than normal numbers of heifers from cow-calf operations begin to show up at the feedlots. Retail beef prices may actually decline at that point because of the increased availability of cattle. It is only in the third year when fewer numbers of cattle are evident through the entire system that beef prices begin to rise at the retail level.

Grain prices started to rise at the end of 2006. The three-year time lag for beef will run its course at the end of 2009. A readjustment "jump" in beef prices is, therefore, still more than a year away. The pork industry is likely to adjust somewhat earlier, perhaps at the beginning of 2009. The U.S. poultry industry will have to wait until 2010 to cash in on increasing beef and pork prices.

Even before the adjustment in the price of the competing meats, some consumers will be switching to chicken due to the weakening economy. Chicken already enjoys a significant price advantage over beef and pork. Because of falling income, some consumers will be switching from beef and pork to chicken long before the price jumps in those meats occur. Nevertheless there is a significant increase in the retail price of beef looming in the not too distant future if high grain prices persist.

.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)