Saudi Arabia’s chicken producers are being encouraged to raise production and follow in the footsteps of the kingdom’s egg sector, which has more than satisfied local demand for decades.

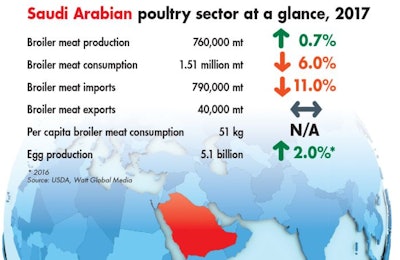

Saudi Arabia’s output of chicken meat and eggs are thought to have continued their upward trends last year with broiler meat output reaching 760,000 tons, up slightly from the 755,000 tons recorded in 2016, while table egg production rose by 2 percent to stand at 5.1 billion.

Output of broiler meat in the kingdom is expected to continue upwards for the foreseeable future, reports the U.S. Department of Agriculture (USDA). The Saudi government has set a strategic goal of satisfying 60 percent of local demand within the next five years, and several development projects are in place to help reach that target.

For example, the country’s largest poultry producer, Al-Watania, is in the process of constructing a mega poultry farm in the province of Al-Jour, which is expected to be operational by 2020. The farm will increase the company’s daily production of broilers from 820,000 to 1 million. Table egg production is planned to rise by 1.5 percent to 3 million eggs per day.

High demand, high hurdles

Saudi Arabia may have one of the highest levels of per capita poultry meat consumption in the world – 51 kg – but satisfying that demand locally is not easy, despite increasing chicken production being a government strategy.

Small and medium-sized farms still confront high levels of bird mortality, mainly caused by disease outbreaks, including Newcastle disease and avian influenza. The country’s Ministry of Agriculture has, however, been working with producers to help bring mortality rates down, and this intervention is thought to have made significant contributions to rising output levels over recent years.

While the government may offer help with vaccines, equipment, feed and other input costs, purchasing land in the kingdom is reported to be difficult and subject to a variety of restrictions, and this is believed to be holding back smaller producers in particular.

Additionally, concerns over the depletion of water reserves have resulted in restrictions on crop production, notes the Food and Agriculture Organization. Cultivation of wheat was phased out in 2016, and green forage crops will be phased out by 2019, meaning that livestock producers are becoming more reliant on imports. The government also is looking to better balance its books and cut back on imports.

Consumption of broiler meat in the country is thought to have fallen last year, due to a large number of expats leaving the country. These departures are expected to continue dragging consumption down. With a local preference for fresh or chilled birds, the decline in population will particularly affect importers of poultry meat, which tends to be frozen.

Approximately half of the poultry meat consumed in Saudi Arabia is imported. However, last year saw import volumes decrease by 11 percent.

Eggs

Saudi Arabia is 114 percent self sufficient in eggs, and exports about 15 percent of production. The industry is highly developed and produced 5.1 billion table eggs in 2016, an increase of 2 percent.