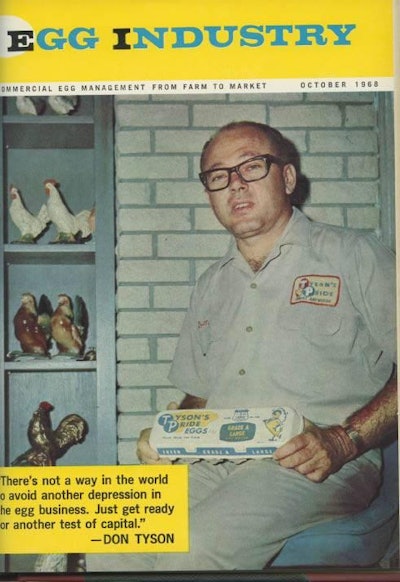

Don Tyson, 38, is president of Ty-son’s Foods, Inc., Springdale, Ark., a publicly held, totally integrated poultry corporation with current annual sales of $55 million. Approximately 10 per cent of that sales base comes from a commercial egg operation consisting of 1,100,000 company-owned layers.

Although relatively new in the egg business (1963), Tyson’s Foods, Inc., has been able to apply to its egg operation much of the business acumen gained through its 30-plus years of broiler meat experiences.

The Tyson philosophy in the egg business is one of company ownership. Only eggs laid by Tyson birds go through the company’s processing plants at Springdale, Ark., Oklahoma City, Okla., and Iola, Kans. No eggs are bought on the open market and none are sold that way.

The company has 10 farms (with flocks ranging from 70,000 to 160,000), its own breeding flock and raises its own started pullets. A pioneer in forward pricing commitments with retailers on its broiler meat products, Tyson has employed the same marketing strategy in his egg operation.

As a publicly held company, Tyson’s Foods, Inc., is under constant pressure to earn a higher rate of return on invested capital than many independent operators would consider necessary. However, the standards Tyson applies to his operation, he feels, should benefit all segments of the egg industry. It will take better-than-average profit performance, he believes, to survive in such a highly volatile business.

These standards include assets-to-liabilities ratio, debt/equity position and debt payment vs. depreciation schedule.

In essence, Tyson does not paint a pretty picture for the commercial egg business. He foresees another depression late in 1969 and still another (and longer one) in ’71 or ’72. He seriously doubts if many existing firms will be able to stand the test of capital they will be facing over the next three years. EI

-“Two more tests of capital – 1969 and ’71 or ’72 – and we’ll see a real grouping in the egg industry.”

-“Forward pricing is a two-edged sword. When the market is low, you feel like a million dollars. When the price goes above the commitment, you feel like you lost a million.”

-“I think the egg industry is in much worse shape than the broiler meat industry. I don’t think there’s a growing market for eggs. It’s an item that is being substituted around.”

-“….the place to price eggs is at the supermarket level backwards. The price should be what a given group of supermarkets is paying …. That’s where our first money comes from.”

-“There’s not a way in the world to avoid another depression in the egg business. Just get ready for another test capital.”– Don Tyson