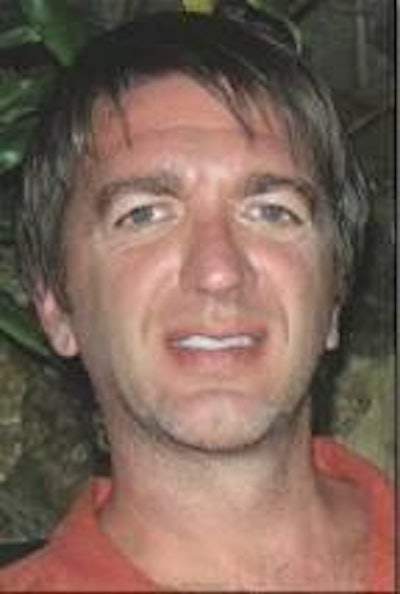

Born in Maquoketa, Iowa, Dave was reared in a farming community. After graduating from Harvard with a degree in government and economics he gained life experience as a political consultant before returning to his home state.

In 1999 he developed a business plan and created a partnership to establish an in-line complex in Rembrandt, Iowa. The enterprise was progressively expanded to 5 million hens comprising a central in-line unit with breaking and eggs supplied by six contractors.

In April of this year, Rembrandt Enterprises successfully negotiated purchase of the assets of Golden Oval Eggs, propelling the company into the ranks of the top ten with close to 12 million hens.

Egg Industry: How do you view the immediate prospects for producers in the U.S.?

Dave Rettig: We are facing an unsettled picture. The industry has had a few good years but this run may be coming to an end. The cyclic nature of our industry will continue but the peaks and troughs may not be as pronounced.

EI: We have seen a marked decline in UB price since Easter. Do you view this with concern?

DR: Egg prices reflect the balance between supply and demand. Our economy is in recession and demand will be constrained at least through the remainder of 2009. Fortunately food purchases for home consumption have not been markedly affected and if hen numbers remain static, the industry should weather the traditional summer downturn at prices above break-even. The industry has, however, benefited from a reduction in ingredient costs from unprecedented levels in 2008.

EI: Rembrandt is committed to breaking; do you consider that this segment will be less affected than shell eggs?

DR: Further processing has a number of challenges. Buyers are extremely aggressive and egg products represent a competitive market. For companies to engage in the egg products market, they need to be in a position to offer a wide variety of products, and this requires sophisticated plants and large complexes.

EI: Which areas of production are being most affected by the current downturn in the economy?

DR: The food service segment has clearly been impacted by consumers moving from restaurant meals to home cooking. Convenience foods are however still in demand and companies which can adapt to changes in market demand by modifying product offerings will obviously benefit.

EI: Your purchase of Golden Oval as a going concern represents a departure for Rembrandt from previous expansion by internal growth.

DR: There are advantages and disadvantages to purchasing existing operations and establishing or expanding company facilities through internal growth. By building new units it is possible to obtain the most modern and often most efficient technology. It is possible to design and locate facilities to complement existing company units. These advantages do however come at a cost. By acquiring companies it is sometimes possible to more rapidly increase production capacity. The Golden Oval acquisition represented a strategic opportunity for Rembrandt and we anticipate synergy from the transaction.

EI: What challenges do you envisage in our industry?

DR: Obviously welfare is an important determinant of both cost and our image. Environmental considerations are continually being addressed including disposal of manure using acceptable technology and mitigation of odor and emissions. Rembrandt has selected battery systems using on-belt manure drying which generate revenue from relatively dry or composted product. Sustainability is emerging as an issue and a number of our larger customers have requested details on our carbon footprint and the measures we have taken to conserve energy and adopt “green strategies.”

EI: How do you view the longer term prospects for the U.S. egg industry?

DR: It is my belief that agriculture will have to be redefined given the challenges of a regulatory environment, the advent of biofuels and escalation in the cost of ingredients, power and labor. Our long term vision is to provide value to our customers. This requires production at a competitive cost. We are buying grain directly from farmers although we have to compete with ethanol producers. Prospects for exports continue to improve especially if we can resolve logistic limitations. Both frozen and dried product can be produced and shipped to existing importers in greater quantities. We must offer domestic markets greater functionality in products and continually improve the supply chain. Service is critical to maintaining goodwill.

EI: How has Rembrandt approached the increase in ingredient costs?

DR: We have concentrated on direct purchase from farmers, offering incentives for forward procurement. In some respects we have an advantage over ethanol plants which have limited grain storage capacity. We believe that it would be possible to partner with our grain suppliers to cultivate corn varieties which are beneficial in terms of yield and possess the nutrient levels which are appropriate to our diets. Naturally we are using enzymes to enhance nutritional value of corn and soymeal.

EI: Despite the obvious problems which exist you demonstrate a high level of confidence in the future.

DR: We have every intention of continuing our growth through product development, service and efficiency.

.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)

.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)