Global poultry meat output is predicted to expand by 1.1% this year to stand at 94.7 million metric tons, the smallest year-on-year increase reported for a decade, says the Food and Agriculture Organisation.

This lower overall growth rate, to a great extent, has been caused by the slow-down in Asia and, in particular, in China. China’s poultry production is forecast to record a growth rate of less than 2% this year, taking total output to 18.3 million tons.

Rising consumption in China has been fuelled by growing purchasing power, particularly among the country’s urban population. However, this engine for growth is now under pressure from the current international financial crisis.

Expansion is also predicted this year in India, Indonesia, Iran and Thailand, despite the impact of last year’s high feed prices. With growth anticipated in virtually all Asian countries, the continent’s combined production of almost 34.2 million tons will account for 36% of the world’s total output, up slightly from the 35.5% recorded last year.

In North America, broiler prices in the USA tended to rise during the early part of this year in the face of sustained demand coupled with tight supply as a result of last year’s higher feed costs. Nevertheless, indications of lower supplies throughout the first half of 2009 point to a cut back in production over the year of around 3% to 19.3 million tons.

In South America, Brazil’s output is expected to grow by only 2% this year to reach 10.5 million tons. Producers have been asked by the Brazilian Association of Poultry Exporters to cut production for export to help counter difficult world market conditions.

Within the European Union, the market is expected to remain largely unchanged with output at some 11.5 million tons. In Russia, however, high growth rates are forecast once again. The production increase anticipated in the Russian Federation maybe nowhere near the 16% averaged over the last two years, yet growth this year could reach 9.4% taking total output to 2.4 million tons.

In Africa, Kenyan, Nigerian and Ugandan producers have struggled against rising feed costs and a lack of credit. In contrast, South Africa’s industry is showing signs of recovery from a difficult 2008 and hence, growth this year is forecast at 5%, pushing total output to almost 1.1 million tons.

Trade

In contrast to the slight upswing anticipated for poultry meat production, the prospects for the poultry meat trade are more pessimistic, with the world total down by some 3% to some 10 million tons, despite the relatively low price for poultry meat in comparison with competitor meats.

The cutback in trade primarily reflects smaller shipments from the USA, as a result of the reduction in import quotas by the Russian Federation. US exports are projected to fall to levels similar to those of 2007, some 3.5 million tons.

The FAO indicates that exports from the EU are also likely to be compromised by the Russian Federation’s reduced purchases and the additional difficulty of some poultry plants being delisted.

The growth in exports from Brazil is also expected to slow because of reduced credit availability and the voluntary export cutback. Nevertheless, Brazil’s total exports this year are projected to be slightly higher at around 3.8 million tons.

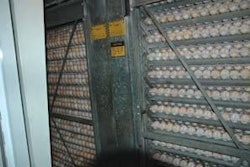

Chart 2: Poultry meat production in selected countries

In 2008, Brazilian exports to China were suspended following concern over the origin of products. This difficulty has been resolved and Brazil resumed exports to China in mid-May. Although the volumes involved are relatively small, China will be an important market for Brazil and its exports will be a threat to those of the US.

The main change to the import side of the trade balance sheet this year is an anticipated 15% reduction in purchases by the Russian Federation to a little over 1 million tons. Alongside Russia’s cutback, the Ukraine and China are also expected to import less.