Indonesia’s poultry meat and egg producers -- and the country’s consumers -- could benefit from greater liberalization of the rules governing key inputs into the sector, argues a discussion paper from the Center for Indonesian Policy Studies. Reform could act as a stimulus to growth and feed through to lower consumer prices, so boosting demand.

Growth and change

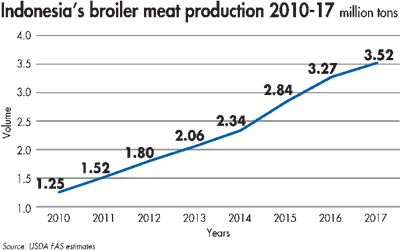

Indonesian production of poultry meat and eggs has undergone significant expansion and modernization over recent years and, while there have been cyclical fluctuations, growth has been consistent throughout the past three decades. Between 1993 and 2013, for example, the Indonesian broiler industry was the sixth-fastest growing in the world.

This growth is set to continue, albeit at a slower pace than in previous years, as the country’s living standards continue to rise and the population becomes more urban. Illustrating this expected continued growth in demand is that all of the sector’s major producers are thought to be engaged in expansion plans. Inconsistent and restrictive legislation, however, may be holding the industry back.

Regulatory reform

Various factors are slowing the sector’s growth. At a regulatory level, this is stifling entrepreneurial freedom and resulting in prices at the consumer level that are higher, for example, than in the U.S. and EU, acting as a brake on consumer purchases and keeping per capita consumption lower than in some neighboring countries.

Where corn imports for feed are concerned, there are contradictions in legislation, which need to be remedied, while opening up the country to international corn markets would further benefit the sector.

Corn imports have been restricted to protect local production. However, this has resulted in poultry producers paying almost double what they would pay if they were able to source from international markets. Feed costs are thought to account for 57 percent of broiler production costs in the country and 72 percent of layer production costs. Liberalizing corn imports would see producers’ main input cost decline significantly, and this could feed through into lower prices for chicken meat and eggs at consumer level.

Similarly, liberalizing parent stock imports would enable poultry-producing companies to more freely implement their own strategies, rather than relying on government estimates of need.

While government intervention in parent stock imports may have been useful when the sector was more fragmented, this is less the case now.

The Indonesian poultry industry has shifted greatly over recent years from comprising smaller farmers using native breeds to being dominated by multinational companies using standard birds. This has brought greater expertise and modernization to the sector, along with supply independence.

Estimates suggest that 60 percent of poultry meat in Indonesia now comes from industrialized farms, with 40 percent coming from small and independent farmers and, according to the Indonesian Public Poultry Association (PINSAR Indonesia), the number of independent farmers has fallen from 100,000 in 2008 to only 6,000 today. Similarly, there has been a shift in preference from native breeds to broilers.

While the discussion paper suggests less intervention in the sector, there are areas, it argues, where government action could act to stimulate production.

The paper notes that greater involvement by the government in infrastructure projects, for example, would ease difficulties experienced by the sector. There needs to be greater connectivity between ports and feed mills, for example, which would not only lower freight costs but also make sourcing of equipment easier, facilitating further modernization and consequent efficiencies.

Egg production

Like the broiler sector, Indonesia’s egg industry, which is estimated to comprise 200 million birds, has also undergone significant change. Indonesia’s egg industry has also been among the strongest performers in the world, with output expanding by more than 90 percent between 2000 and 2013.

At the start of this decade, the sector was producing a little more than 1 million tons of eggs. By 2017, this had increased by 62.4 percent to stand at 1.7 million tons.

Over this period, output from commercial layer breeds rose by almost 68 percent to stand at 1.5 million tons, while the share of eggs coming from native breeds fell from 15 to 12 percent.

Per capita broiler meat and egg consumption are lower in Indonesia than in many neighboring countries.