Higher U.S. leg quarter prices are a boon for the global poultry trade, according to a veteran economic observer.

As part of the International Poultry Council’s First Semester Conference in New Orleans, Paul Aho, an economist and consultant with Poultry Perspective, spoke about the current state of the global chicken trade and the factors that could influence the near future. Aho spoke on April 16, 2019.

U.S. leg quarter prices

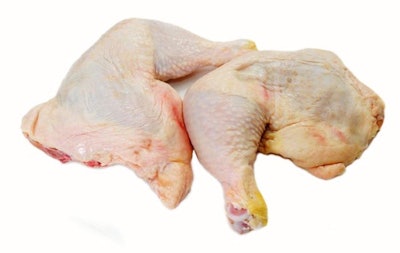

A key export from the U.S. is the chicken leg quarter. American consumers traditionally preferred white meat, leading to a surplus of cheap dark meat headed for export. Aho said that’s changing.

Over the past 18 years, the price of leg quarters steadily increased. In just the past three months, the U.S. market is finding an appreciation for deboned thigh meat. Historically, the U.S. industry provided little deboned thigh meat due to concerns the market was thin and an oversupply of the product would drop prices.

However, consumers in the U.S. are increasingly choosing dark meat, which is reducing the supply of leg quarters for export and driving up leg quarter prices. He said a higher U.S. leg quarter price is more acceptable for the international market, and the price may even go higher in the future.

The benefits of importing chicken

Speaking to an audience of international poultry professionals, Aho focused on the factors influencing the international chicken trade and why freer trade is better than restricted trade.

In general, he said, 88 percent of chicken is produced and consumed in the same country. As a rule, the chicken trade is subject to a number of international barriers and is highly regulated. Although some may fear lower prices of imported products spawned by freer trade, those fears may be unfounded.

Aho said the supposedly scary low prices of chicken will be mitigated by the costs of transportation and international transactions. Essentially, the value of the product on the dock is not the same price that will be paid upon arrival.

To consumers, fresh local products are almost always worth more than frozen imported products. Moreover, chicken consumption is not a zero sum game. When more products are imported, total chicken consumption typically increases.

A projection for the future

Currently, only 12 percent of global chicken production is exported. Aho expects that can easily go up to 15 percent in the coming three years if there was slightly freer international trade. The additional 3 percent of exports would amount to about 4 million metric tons of chicken being traded globally. Even in this scenario, 85 percent of chicken would still be produced and consumed in its home country.