Since the onset of coronavirus in the United States, grocery retailing conditions have been unlike any ever experienced in recent history. Unprecedented pantry, fridge and freezer loading by consumers across the United States emptied stores for days and weeks on end, resulting in incredible sales surges and widespread out-of-stocks conditions.

During the week of April 12, many stores further sharpened safety measures, such as metered entry, asking shoppers to limit visits to one person per cart and encouraging consumers to shop just once a week, while avoiding stocking up on any one item.

Meat leads fresh perimeter sales

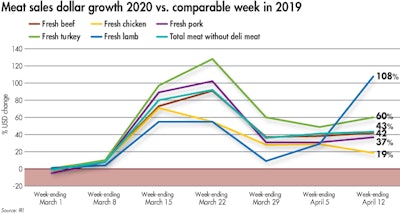

During these past six weeks, the meat department has emerged as the sales leader of the fresh perimeter and the week of April 12 was no different. Dollar sales increased 43% over the comparable week in 2019 and volume sales increased 36%. This means rather than slowly trending down, sales were actually up week over week as well as year over year. Total perimeter sales were up 18% and food sales excluding fresh were up 30%.

The impact of the Easter week can be seen in the types of proteins and cuts sold in fresh, such as lamb. While sales were undoubtedly influenced by Easter, celebrations were hardly typical with most consumers under shelter-in-place mandates. This points to a continued higher everyday demand as well.

All meat and poultry continued to sell far above typical levels. While small from a dollar perspective, lamb posted the highest percentage gains (+108%), followed by turkey (+60%). Beef continued to have the highest absolute dollar gains (+$188 million). Year-to-date, dollar gains for total meat are up 20.2% over the comparable period in 2019.

What’s next?

The third week of April still saw great uncertainty about the “re-opening” of the country. While states were encouraged to begin lifting their executive orders in a phased approach under strict criteria when it is safe to do so, many states extended their stay-at-home orders.

The top question on everyone’s mind is how far the new baseline lies above the old normal. Reality is that it is too early to tell. There has not been a good indicator week yet of what will be the “new normal.” Mid-March had the enormous panic purchasing surge, followed by subsequent social distancing and shelter-in-place surges. Next were the two weeks leading up to Easter. In the upcoming two weeks, sales will go up against Easter 2019, which fell on April 21, which yet again complicates any sense of normalcy and data predictions.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.