Two months into the COVID-19 pandemic, grocery shopping continues to evolve, and the meat purchase along with it.

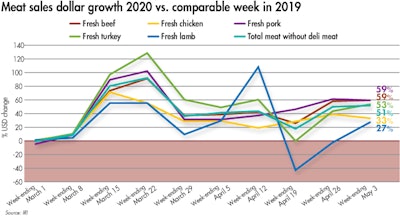

Throughout the nonstop evolution of shopping patterns, there has been one constant: the meat department has been the undisputed sales leader of the perimeter. While the prior week sales gain of 50% seemed tough to beat, the prominent coverage of plant closures in the consumer media drove yet another wave of shoppers stocking up on meat and poultry.

Supply chain challenges

During the past two weeks, many stores put purchase limits in place for certain cuts or a limit for the total number of meat packages that could be purchased per customer. But supply is likely to continue to impact the dollar and volume performance in weeks to come.

The limited supply is felt at retail. Many consumers commented on the sparse inventory levels during the week of May 3 on the Retail Feedback Group Constant Customer Feedback system. “The chicken was mostly out. I know that you cannot control what people are going to hoard and it is hard to keep items in stock through no fault of your own. There were only some wings and some drumstick and one lonely whole chicken. I was looking for fresh chicken breasts.”

Out-of-stocks at primary stores also drove consumers to explore different channels and outlets. Important beneficiaries of new engagement were grocery stores as well as limited assortment powerhouse ALDI, according to IRI research

Affects on wholesale and retail prices

The supply chain woes have affected wholesale and retail prices.

“Beef prices spiked to new highs this week and more than double year-ago levels, driven by ongoing strength in chucks and rounds. Tight pork supplies helped buoy prices to levels not seen since 2014. Renewed interest from foodservice drove sharply higher pork belly prices, that doubled in the past two weeks, while loin prices were up 39% over the same period. Chicken prices are also stronger on tighter supplies of beef and pork. Prices of boneless breast meat were +23% week over week, as the industry lacks labor to debone and as supplies of ground beef have become scarce,” said Christine McCracken, Executive Director Food & Agribusiness for Rabobank.

What’s next?

Prompted by the continued media coverage of meat shortages and rising prices, the run on meat continued the second week of May and will likely result in continued high gains for the week ending May 10. Additionally, Mother’s Day may have provided another small sales boost with restaurants in most states still closed or open with limited seating capacity. For the foreseeable future, it is likely that grocery retailing will continue to capture an above-average share of the food dollar with meat in a starring role.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.