Memorial Day signals the traditional start of the summer grilling season, with meat and poultry promotions typically dominating the front page of grocery circulars around the country. This year, however, tight supply along with price inflation and continued social distancing measures created a very different marketplace and demand.

In point of sale data, the gap between volume and dollar sales was the widest since the onset of coronavirus, at more than 15 percentage points for the week ending May 24 — signaling continued pressure on pricing due to tightness in the supply chain.

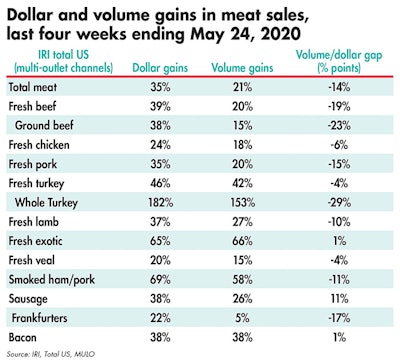

The longer, four-week look ending May 24 showed continued double-digit volume/dollar gaps for fresh beef and pork, but for other fresh species dollars and volume started to track closer together, including chicken, turkey and exotic meats. Several processed items, including sausage and frankfurters continued to show double-digit volume/dollar gaps also. Bacon, still in ample supply, is one of the few items where dollar gains and volume gains have been tracking very closely together throughout the pandemic.

Supply issues

Supply pressure appears to be lessening some post Memorial Day due to supply issues improving and demand from retail softening a bit.

“The chicken industry faced limited disruption this past week with ample labor and plants able to run on Saturdays to maintain production volumes. Chicken supplies will soon tighten however, as production cuts in April and May will begin to limit availability,” said Christine McCracken, Executive Director Food & Agribusiness for Rabobank.

On the demand from food retail and foodservice McCracken commented, “Retail interest following the Memorial Day holiday is softer for many items, with some buyers taking a more cautious approach given uncertain consumer interest. We noted some consumer push back to higher prices on shelf and limited ad activity on beef and pork. We continue to see items on allocation in some chains, however, with production normalizing these product outages have become less frequent. Foodservice demand for most items slowed this week, with pipelines now replenished and consumer demand still slow. Demand for tenders and wings is steady, while ground product interest is also good.

What’s next?

The next sales report, covering week 12 of coronavirus’ affected shopping patterns, is the final week of May. For some states, that coincided with the start of summer vacation. Since mid-March, the closing of schools and colleges brought many more meal occasions to at-home. Now, the altered COVID-19 consumption patterns will go up against summer vacation will go up against summer vacation consumption patterns of prior years.

Meanwhile, the relaxation of the stay-at-home executive orders looks different from state to state. Many have relaxed mandates allowing some consumers to shop, dine and work out of home. The economic recovery along with the foodservice engagement in those states will be very telling for the likely level of demand at food retailing for the foreseeable future. Given the limited seating, economic pressure and perhaps some latent social anxiety, it is likely that grocery demand will continue to sit well above the 2019 baseline, with meat in a starring role.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.