The week ending July 12 was a non-holiday week, but did bring better prices in the meat department along with more consumers shopping for food.

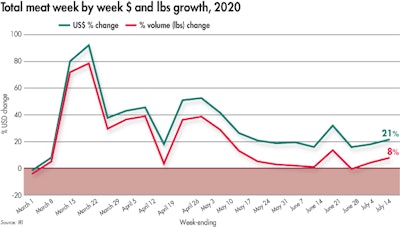

The elevated everyday demand resulted in a 21.4% increase in dollar sales versus year ago. Non-holiday weeks had been seeing some erosion in gains, but this represents a five percentage point increase from the latest non-holiday week, which was June 28.

This also became the 17th week of double-digit gains since the onset of the pandemic. While higher prices drove much of this gain, volume increased as well, at +7.7%. This was the highest volume gain during a non-holiday week since mid April. Unit purchases in the meat department increased by 16.2 million, or 8.1%, over the week of July 12 versus last year, while volume increased 7.7%. This points to more, but smaller, packages sold.

So far during the pandemic, starting March 15 through July 12, dollar sales are up 35.9% and volume sales have increased 22.5% versus the same period last year. This translates into an additional $7.4 billion in meat department sales during the pandemic, which includes an additional $3.3 billion for beef, $1 billion for chicken and $794 million for pork.

Price

IRI’s insights on the average retail price per volume show double-digit increases when comparing prices during the week of July 12 to the same week in 2019, and a mild increase versus the prior week. While beef prices were stable versus week ago, chicken’s price per volume showed the highest increase, at +5.1% versus the prior week. However, the four week versus one-week look shows that meat prices have come down somewhat, at +14.7% versus +12.8%.

Christine McCracken, Executive Director Food & Agribusiness for Rabobank, provided an updated on wholesale pricing. “Demand for chicken is steady, with lower prices on boneless breast meat attracting some retail interest. Wing demand remains outstanding and ahead of expectations, particularly given potential disruption in fall sports and foodservice outlets in some regions. Exports of chicken continue to struggle, leaving larger supplies of dark meat on domestic markets. Plentiful competing meat supplies have limited retailer interest in thighs and drums, but this could improve as consumers seek out value options.”

Gains by protein

The overall 21.4% meat department gain was fueled by double-digit gains for all proteins, with the exception of chicken that gained 8.8%. Lamb and beef had the highest percentage growth, at +31.1% and +30.1%. Beef easily had the highest absolute dollar gains (+$134 million), followed by pork (+$25 million) and chicken (+$20 million).

What’s next?

This was the first of a stretch of eight non-holiday weeks until Labor Day, that falls on September 7. This means everyday demand alone will need to drive the gains over last year’s levels.

As COVID-19 cases are rising across many states, several rolled back the re-opening of restaurants and businesses. In some cases, the rollback prohibits in-restaurant dining altogether, in others, dine-in capacity was more restricted — much like late March and April. The reversal on restaurant openings along with rising consumer concern over COVID-19 is likely to shift dollars back from foodservice to food retail once more.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.