The Japanese egg industry can offer some valuable lessons for its counterparts in other developed markets. While Mexico may have the highest per capita egg consumption (367) in the world and China may be the country that produces the most eggs (34.7% of global production), Japan can claim quite a few first-in-class achievements of its own.

Since 2000, the Japanese layer flock has decreased by about 1% to 139 million hens and the country has lost over 50% of its layer farms. Yet Japan has still managed to expand its egg production.

Despite having fewer birds in production the country has raised egg output by 3.6%, with production efficiencies being among the keys of its success. The consolidation that has taken place in the sector becomes evident when you consider that only 10 companies now account for approximately 40% of egg production – one of the highest concentrations in the world.

However, while the industry may have grown its output, the Japanese population has remained stable over the last decade at 127 million. Each Japanese citizen now consumes more eggs which increased demand.

Annual per capita egg consumption in Japan has risen from 325 to 337 - an increase of 3.5% over the last decade. To ensure that this trend continues, marketing plans are underway to convince consumers that "eating two eggs a day makes a happy smile for all."

Method of consumption

Increased efficiency and ever-rising per capita consumption are not the only factors that set Japan apart.

Japan is the only country in the world where consumption of egg products is higher than the consumption of shell eggs. In 2018, it was estimated that, of the 337 eggs eaten by Japanese consumers annually, 170, or 51%, were in the form of egg products. To place this into perspective, the percentage of eggs eaten as egg products in North American and European countries is way below that of Japan at only 20-35%.

The egg processing sector has traditionally been extremely well developed in Japan. The country has about the same number of egg processing plants as the U.S., the world's largest producer of processed eggs.

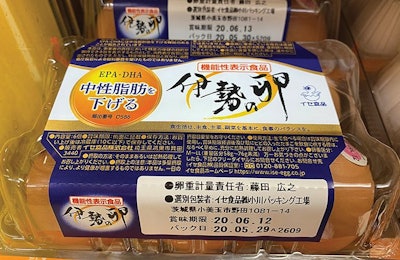

Importantly, in the early 1990s, Japan developed the concept of functional foods - where foods are recognized as delivering more than simply nutrition. While several functional claims can be made in Japan for regular eggs, egg producers have also developed numerous functional eggs, with enhancement in nutrients such as Omega 3 fatty acids (EPA + DHA), lutein, carotenoid pigments and iodine. It should, therefore, be no surprise that approximately 30% of the eggs sold at retail come with functional claims - probably the highest percentage in the world.

These value-added eggs are sold at a premium, adding to the profitability of egg production in a country where many poultry feed ingredients have to be imported and are expensive.

Last and not least, no country in the world is home to so many dishes containing raw eggs. For example, it is common in Japan to order a noodle dish where a raw egg is placed on top of it, to then be mixed with the other ingredients.

While some countries are enjoying growth in egg consumption driven mostly by favorable demographics, Japan has clearly shown that growth in consumption – both volume and value - can also be achieved in a mature market. For those egg producers in countries forecast to see a population decline, the Japanese industry offers some valuable examples.

Modern egg farming practices shield human health