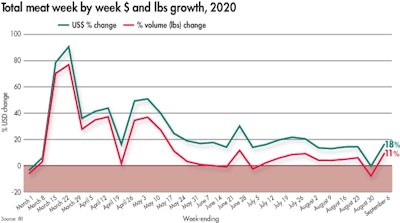

Following its first single-digit gain since the onset of the pandemic last week, the meat department bounced back strongly. For the week ending September 6, dollars gained 18.2% over year ago levels during one of the biggest grilling weekends of the summer. Volume gains jumped into double digits as well, at +11.4%. The week of September 6th had 11.2% more transactions compared to same week year ago.

Already a strong grocery holiday during regular times, expectations for Labor Day grocery sales were high and reality did not disappoint. The holiday fell a week later than in 2019, which helped further boost the results in departments across the store, including the meat department. These results were positively influenced by the off-timing between the 2020 and 2019 holidays. However, if we were to compare the holiday weeks against one another directly, the 2020 performance remains impressive, up 15.9% in dollars and +8.5% in volume.

So far during the pandemic starting March 15 through September 6, overall meat dollar sales are up 30.1% and volume sales have increased 18.0% versus the same period last year. This translates into an additional $8.9 billion in meat department sales during the pandemic, which includes an additional $4.1 billion for beef, $1.2 billion for chicken and $909 million for pork than the same period in 2019.

Price per volume and volume/dollar gap

According to the IRI insights on the price per pound volume, prices continued to drop in favor of the consumer, with an average of $3.71 per volume across all meats during the week of September 6 versus $3.76 the week prior.

Retailers invested in price during the Labor Day weekend, with ground beef, chicken, pork, turkey and exotic meats (including bison) all right around last year’s pricing levels. Only beef (other than ground beef) and lamb continued to have higher levels of inflation.

The big grilling powerhouse meats, including beef and pork, all had very strong weeks. Beef increased more than 25% in dollars and 19% in volume versus the same week year ago. Smaller proteins, including lamb and exotic meats continue to have strong sales gains during holiday and everyday demand weeks — perhaps signaling that some of the protein switching seen during the weeks of tight supply are here to stay.

“Chicken prices remain relatively flat, with the exception of wings which continue to outperform as foodservice demand remains stout. Boneless breast meat prices remain weak and are frequently discounted, as supplies remain large and foodservice demand has been unable to clear supplies. Reported disruption at some U.S. plants has not slowed RTC chicken production (up 3.7% in the last month) as heavier bird weights more than offset lower total slaughter,” Christine McCracken, Executive Director for Animal Protein for Rabobank, said.

The pandemic sales performance by area

Meat department sales were $1.398 billion during the week of September 6 — about $168 million higher than the week prior for a week-over-week gain of 13.7%. On the fresh side, beef accounted for 57.1% of dollars. Chicken was next at 23.6% of dollars. Processed meats had a very strong Labor Day week as well. Hot dogs ended the summer season on a very high note with dollars up 28.0% versus year ago levels.

What’s next?

This is the last in the weekly series of meat performance reports IRI and 210 Analytics have produced since the week of March 15, after which the reports will continue on a monthly basis.

Excluding weeks that were affected by the 2019 or 2020 holiday demand, everyday demand is normalizing at around 10%-15% above year ago levels, depending on how price inflation will impact dollar sales. The number of new COVID-19 cases appears to be leveling off and consumer concern along with it. Restaurant transactions continue to come back a little at a time, but remain below year-ago levels. Aided by the effect of virtual schooling and working-from-home, meat sales are likely to hold well above 2019 levels for many weeks to come.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.