November sales are dominated by the all important Thanksgiving holiday — one of the largest retail opportunities in meat and many other retail departments. This makes it a hard-to-beat sales occasion any year.

However, throughout October and November, shoppers’ concern over COVID-19 rose along with the number of new cases. This resulted in very different Thanksgiving celebrations versus typical years, with less travel, smaller gatherings and earlier shopping to avoid crowds.

Much like seen throughout the year, elevated concern also translated into a greater spending at retail versus foodservice. During the month of November, sales for all food-related items (total edibles) increased 9.3%, which was up from 8.6% during the month of October.

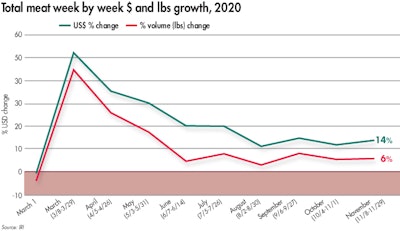

Meat department sales during the week ending November 8th through November 29 increased 13.9% in dollars and 5.8% in volume versus year ago. This reflects an increase for both dollars and volume over October.

Year-to-date through November 29th, overall meat dollar sales have increased 18.8% and volume sales have increased 10.4% versus the same period last year. This translates into an additional $12.0 billion in meat department sales during the pandemic, which includes an additional $5.3 billion for beef, $1.5 billion for chicken and $1.1 billion for pork than during the same period in 2019.

Meat gains by protein

Lamb continued to have the highest percentage gains on its small base, at +34.0% versus the same month year ago. Lamb has seen a steady increase in its gains month-over-month. With restaurants in many states closing back down in terms of on-premise dining, it is likely that more lamb sales will continue to flow through retail.

Beef’s performance continued to be astounding, up 18.7% during October. Various high-end cuts had strong Thanksgiving sales, perhaps a reflection of a choice other than turkey amid smaller gatherings.

Chicken saw the smallest gains during the months of May through October, but had a strong November, perhaps with some shoppers opting for a whole bird chicken as their main meat, that increased 7.3% during November.

What’s next?

Everyday demand continues to hold around 15% above year ago levels with renewed shelter-in-place restrictions and rising COVID-19 cases likely to push more dollars to food retail once more. Additionally, the comeback of restaurants transactions is hampered by colder temperatures in northern states. Aided by the effect of online sales, trip reduction, virtual schooling and working-from-home, meat sales are likely to remain well above year-ago levels for many weeks to come.

The end-of year holiday demand is likely going to be very different, much like Thanksgiving. According to the latest weekly shopper survey wave by IRI, conducted mid-November, the holidays will involve much less travel and smaller gatherings.

- Only one in four shoppers plan to celebrate with others outside their household, about half the rate of 2019.

- One in three expect to spend less on groceries for the December holidays this year, primarily due to hosting fewer/no guests this year or cutting back to save money.

- For New Year’s, 30% plan to celebrate at home without guests, while only 5% of primary grocery shoppers plan to go to a party/gathering, 4% host others, and 3% go to a bar/restaurant. 10% celebrated last year but won’t do anything either at home or away from home to ring in the New Year (51% typically don’t celebrate).

These predictions point to many potential changes for the meat department. Much like the pandemic-affected holidays to date, packer/processors and retailers may consider messaging and promotions that help shoppers find new ways to make the holidays special at home or on a tighter budget, and retailers should plan for an earlier spike in holiday item purchasing than last year.

View our continuing coverage of the novel coronavirus (COVID-19) pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.