Domestic integrators faced unprecedented challenges in 2020 which led them to dial back egg sets and chick placements.

Impacts of reduced demand

Although surface-level profitability estimates suggest financial conditions in the industry were not all that bad in 2020, widespread restaurant closures last spring, created a colossal, albeit temporary, marketing void.

Chicken companies reacted by severely restricting the flow of fertilized eggs going into incubators and reducing the number of chicks available for placement on grow-out farms.

Industry players did not abandon this guarded approach even as the initial shock of the pandemic wore off. Surging feed costs later in 2020 represented another source of tension encouraging supply reductions.

Reduced hatchings offset breeder flock growth

Recent years featured significant capacity expansion by the U.S. broiler industry and breeder flocks increased to accommodate this growth.

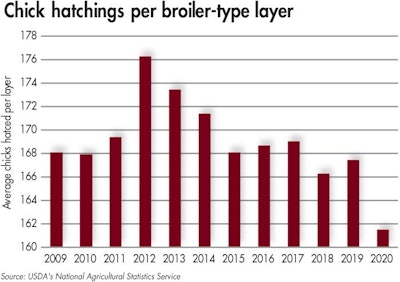

Despite all the turmoil last year, the broiler-type laying flock increased by about 3% from 2019, to an average of 61.1 million hens, according to U.S. Department of Agriculture (USDA) estimates. That was offset by a nearly 4% decline in the average number of chicks hatched per broiler-type layer, which resulted in 2020 slaughter levels being roughly flat compared to a year earlier.

Chick hatchings per layer is a measure of productivity driven primarily by biological factors related to the age and health of active breeder hens, but the events of 2020 provided a useful reminder of just how much human influence can be imposed on this metric.

Uncertain growth trajectory for 2021

Based strictly on the breeder flock size, the industry remains positioned for moderate to robust expansion in 2021.

Layer inventories during the fourth quarter of 2020 averaged more than 3% above year-prior levels. That said, with profit margins under pressure from surging feed costs, integrators maintained their restrictive posture on the hatchery front.

Chick hatchings per layer declined 5% from year-prior levels during the fourth quarter of 2020. With broiler slaughter weights also being pared, the stage is set for ready-to-cook production to be down at least 3% from year-prior levels during the first quarter of 2021. That would represent the biggest drop in quarterly US broiler production in a little over a decade.

The path from there is much less certain. Layer inventories are big enough to support fairly robust growth in spring 2021 and even farther out into the year. But this would require integrators allowing hatchings per layer to rebound back in the direction of normal.

It is unclear how much of an appetite integrators will have for this in a challenging margin environment. However, they are also likely weary from managing their breeder flocks and hatcheries so inefficiently.