While early on in the pandemic many shoppers started out indulging in traditional and “comfort food” choices, January kicked off with New Year’s resolutions for 64% of shoppers. More than one third, 35%, aim to eat healthier, in general; 35% want to get more exercise; and 29% plan to save more money, according to the IRI Consumer Network survey conducted in January 2021. For meat, this means the consumer’s eye is on nutrition as well as price and promotion.

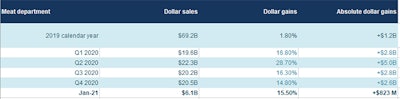

January saw a recovery of trip frequency to slightly above year ago levels while the basket size remained highly elevated. This resulted in high gains over January 2020 levels for total edibles, which is all food and beverage related items, at +12.7%. This is up significantly from a subdued December (+8.1%).

January meat department sales increased 15.5%, excluding online-only and delivery e-commerce sales, but does include pick-up-in-store fulfillment like click-and-collect and personal shopper delivery. IRI shopper research finds that 16% of shoppers are ordering their groceries online more, with all but 6% of opting for click-and-collect fulfillment versus direct-to-home delivery or pureplay online with no physical store. All in all, meat department multi-outlet sales for the four weeks ending January 24th gained an additional $823 million versus the comparable period in 2020

The meat department dollar sales gain of 15.5% exceeded that of the fourth quarter and, importantly, the volume gains were the highest since the second quarter of 2020, at +9.3%. Dollars and volume trended 6.2 points apart — significantly closer than during most of 2020.

Fresh meat made up the majority share of sales, at $4.1B and had slightly higher gains (+15.6%) than processed meats (+15.3%) in January 2021. However, volume gains were slightly higher for processed meats, at +9.5%. That resulted in the gap between volume and dollars falling below the six percent mark for processed meats, whereas fresh remained at 6.4 percentage points.

In January 2021, beef accounted for 64% of all additional dollars over this month in 2020, reflecting a share gain of 19.0% over year ago. Chicken was the second-largest contributor to sales gains, at +$90 million versus year ago. Lamb had the highest percentage dollar gains, at +30.4%, but off a much smaller base.

Lamb has had the highest percentage gains since the third quarter of 2020 and has remained very stable at around 30-34% over year ago levels. Beef, while the largest of the fresh proteins in dollar sales, has consistently posted the second-highest growth, in the high teens. Chicken and turkey gains have been in the high single, low double digits in the last few quarters and January 2021. Turkey saw high levels of promotional discounts in the fourth quarter and low inflation in January.

What’s next?

January showed that everyday demand continued to hold at double-digit above year ago levels. February has a strong sales opportunity in Valentine’s Day — traditionally a big out-of-home dining occasion, particularly in years where the holiday falls on the weekend. Additionally, continued high counts of COVID-19 cases and cold weather gripping much of the country should spell a more at-home focused occasion than in years past.

Looking further into the future, working from home full time is expected to remain more than twice as high as pre COVID-19: 44% of employed Americans expect to work from home at least once a week after the vaccine is widely distributed and restrictions are lifted, according to the January wave of IRI shopper research.

Likewise, the majority of children were still participating in remote learning in January. About six in 10 school-aged children were in a remote-only model and another 15% in a hybrid approach. Schooling patterns were similar for younger kids, ages 6 to 12 as they were for teens.

Nearly four in 10 (39%) shoppers expect the health crisis to last more than 12 more months, with an additional 32% expecting it to last another seven to 12 months.

View our continuing coverage of the novel coronavirus (COVID-19) pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter