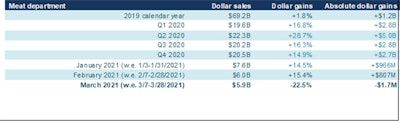

In March 2021, sales started lapping the enormous spikes of 2020 and the comparison to year-ago levels turned negative for of the meat department even though the demand stayed well ahead of the 2019 baseline.

March 2020 experienced the biggest spikes in the history of grocery retailing as the nation bought supplies to fill their freezers, fridges and pantries in preparation for shelter in place. 210 Analytics analyzed performance data provided by IRI.

Comparing 2019, 2020 and 2021 sales levels

The meat department was an above-average performer since the very start of the pandemic. That means when going up against those sales spikes, meat dropped further behind year-ago levels than other perimeter departments, including produce, deli and bakery. Meat department sales for the four weeks ending March 28th dropped 22.5% against 2020 levels, however, actual dollars were virtually unchanged from February at $5.9 billion.

March 2021 marks the first time in over a year that meat department sales fell below year ago levels. However, compared to the pre-pandemic March 2019 normal, sales still tracked 18% ahead in dollars and 8.5% ahead in pounds in March 2021.

Fresh meat made up the majority share of sales, at $4.0 billion, which is unchanged from February. Fresh also had slightly lower declines than processed meats in March 2021. The gap between volume and dollars stood at 2.5 percentage points, significantly lower than seen throughout most of 2021 as we are starting to lap the periods of high inflation as well.

What’s next?

With an early Easter, on April 4, much of the Easter lamb and ham sales would have fallen in the March calendar month while the 2020 Easter season was heavily disrupted by shelter-in-place mandates in the vast majority of states.

Meanwhile, several indicators of the consumer mobility — reflecting how much people are moving around to go to school, work, out to dinner, vacation or visit family and friends, etc.— are trending up. Increased mobility is also likely to result in a shift from home-centric food spending to greater foodservice engagement but may also drive increased demand for time-saving, convenience focused solutions.

Other pertinent findings from the IRI survey with primary grocery shoppers conducted in March include:

- Working-from-home continues at highly elevated levels compared to pre-pandemic. As of March 2021, 44% of those who work at home some or all days a week believe they will continue to do so after getting the COVID-19 vaccine. This means a continuation of more at-home breakfasts and lunches and less dinner-time commuting.

- As of March 2021, 45% of younger school-aged children are still partaking in virtual education only. This share is slightly higher among teens, at 52%. These numbers continue to change as more school districts are experimenting with partial in-person schedules — impacting breakfasts and lunches.

- More consumers are comfortable in store, with the share saying they are “relaxed” up from 40% in May 2020 to 61% in March 2021. This goes hand-in-hand with an increase of the average time spent in the store. This creates a more favorable environment for new item introductions along with robust interest among consumers for meal solutions and meal preparation or assembly.

- The nation’s pent-up demand for eating out at restaurants is translating into 40% expecting to dine out as often or more often as they did before the pandemic. This is up from a low of 19% during July 2020. However, that still leaves 60% of consumers who continue to prepare meals at home more frequently than they did pre-pandemic.

- Online sales started spiking a little later than in-person sales in March and April 2020. The generally high satisfaction levels translate into 68% of online grocery shoppers believing they will continue to shop online at similar rates after being vaccinated. An additional 11% believe they may buy groceries online even more often. This bodes well for grocery e-commerce to be able to keep pace with the records set in 2020.

View our continuing coverage of the novel coronavirus (COVID-19) pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.