Inflationary pressures gripped protein markets in 2021. The trend carried over to the first half of 2022 with consumers experiencing full-fledged sticker shock.

As summer wound down, prices for protein products retreated implying the inflation threat was potentially fading. Late fall is turkey’s time to shine and high prices remain a prominent feature as a result. Inflation in this segment is fueled at least in part by the highly pathogenic avian influenza (HPAI) related losses exacerbating an already-tight domestic supply.

Supply squeeze

Between February and August 2022, approximately 5.8 million turkeys were culled due to HPAI. That’s 2.7% of all turkeys slaughtered in the U.S. in 2021. Most HPAI cases were identified in spring, early in the growout cycle, causing lingering effects on slaughter well into summer.

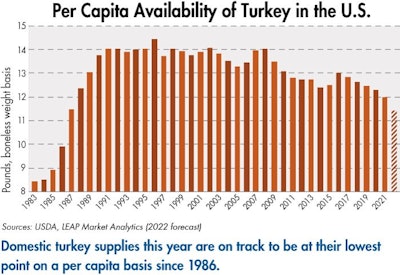

Ready-to-cook turkey production in the U.S. totaled 391 million pounds in July 2022, marking the smallest monthly output since February 1999. Year-over-year domestic per capita availability of turkey is on track to decline nearly 5% between 2021 and 2022 and slump to its lowest point across a full year since 1986.

Record prices

Turkey prices were already trending up thanks to favorable demand-side trends, but the added supply squeeze from HPAI sent markets even higher.

The U.S. Department of Agriculture reported spot market prices for frozen 8- to 16- pound hens above $1.60 per pound. Quotes in the fresh whole turkey category already touched $1.80 per pound.

These prices are all-time highs for the whole turkey complex. Spot prices are well-positioned to stretch even further into record territory with the peak marketing stretch for the upcoming holiday season still ahead.

Alternatives are lacking

Record wholesale prices for whole turkeys will presumably translate into elevated prices at the retail end of the value chain.

Consumers may be tempted to pursue alternatives for their holiday meal offerings. Some possible substitutions include turkey breasts, whole chickens, hams and beef tenderloins.

Many of the same forces behind whole turkey prices launching to record territory also lifted the turkey breast market to an all-time high. Beef tenderloins occupy a different, and much higher, price stratum than whole birds. As a result, neither is very attractive as a substitute.

Whole chickens and hams represent more comparably priced options, but these categories also experienced considerable inflation relative to historical price levels. It is looking like it will be an expensive holiday season all the way around.

Poult placements are trending higher again, an early signal of expanded turkey production and supplies in 2023. Retail buyers, and ultimately consumers, should see a little price relief eventually.