Rising costs, disease outbreaks and growing imports mean that French poultry producers currently have little to celebrate, despite France being the largest consumer of poultry meat in the EU.

Broiler industry association ANVOL notes that, while the volume of poultry meat consumed in the country rose by 2.1% last year, with per capita poultry meat consumption reaching 28.5 kg, or a total of 1.926 million metric tons, total poultry production will contract by 9.7% this year. France will fall from being the EU’s second largest poultry meat producer to its fourth.

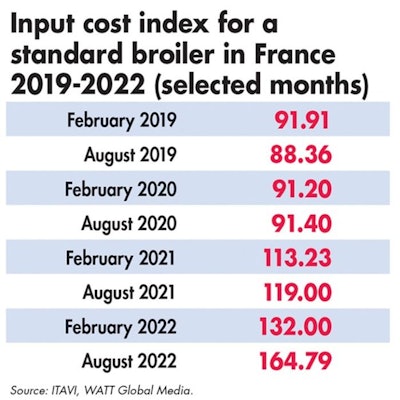

Like its competitors around the world, the French industry is suffering from rising costs. ANVOL notes that the sector is confronting increases that have never been seen before. For example, the cost of producing a live bird has risen by 45-50% over the last two years.

Feed costs remain high, while the cost of chicks, energy, packaging and labor are also all higher. The applied research and development institute ITAVI reports that the cost of feed rose by 80% over the two years to August 2022. It also notes that energy costs in the first quarter of this year were 17% higher than in the first quarter of 2020, subsequently rising by 30% during the second quarter. The increases are forecast to continue.

ANVOL warns that these increases are threatening the industry’s contractual production model and while it welcomes government support measures, particularly where feed is concerned, it worries that accessing support to cover higher energy costs is far too difficult.

Imports continue growing

French producers are not, however, simply facing rising supply costs, they are also facing ever growing competition from lower cost imports.

ANVOL argues that these imports are not subject to the same stringent regulations placed on EU production and that birds are not reared to the same standards as their French counterparts.

Over the first five months of this year, 49% of the poultry meat consumed in France was imported, up from 45% over the same period last year. Chicken meat imports from Brazil, for example, have risen by 122%, while those from Ukraine have grown by 181%.

Avian influenza

France has experienced its worst ever outbreak of avian influenza (AI). All sectors of poultry production have been hit, both in terms of severity and duration of outbreaks, and ANVOL reports that the crisis has become severe enough to threaten the variety of birds produced and the variety of production methods practiced in the country.

Turkey production, for example, declined by 12.7% over the first five months of the year, while duck production was down by 17.9%. This has resulted in lower availability and lower consumption for these meats, with turkey consumption down by 15.6% and consumption of duck meat falling by 22%. Consumption of guinea fowl is reported to be 2.7% lower.

Chicken production, however, is said to have grown by 3% over the period and increased its market share by 6.6% compared to the first five months of 2021.

Chicken is by far the most consumed poultry meat in France and its popularity continues to grow. In 2021, chicken accounted for over 76% of all poultry meat consumed. Over the first five months of this year, it accounted for over 80% of the poultry meat consumed in France.

The growth in demand for chicken meat this year has been attributed to the lack of supply of other poultry meats and to the return of restaurant and catering activities.

Chicken has been the motor of growth in the poultry industry for some time now. Chicken production has grown by an average of 1.8% per annum over the last decade, while consumption has grown by 3.6% each year.

Citizen action needed

With sector output forecast to contract by close to 10% this year, the industry is calling not only on the government for support but also on consumers to preserve France’s food sovereignty.

The French public is being urged to only buy products with the origin label “Volaille Française." Doing so, ANVOL says, will help to support the 100,000 professionals that work in the French poultry supply chain and the 34,000 who work on farms.