Chicken prices collapsed, along with demand, in the second half of 2022. This sets up a bleak picture for integrator profitability.

Prices fall

In May 2022, according to the U.S. Department of Agriculture estimates, spot wholesale prices for boneless skinless breast meat averaged about $3.50 per pound, an all-time high. At the same time, whole wing prices – off record prices of their own in 2021 – averaged less than $2 per pound.

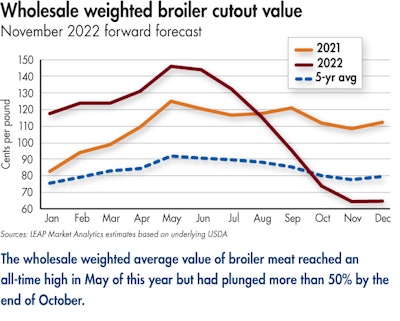

By the end of October 2022, both parts saw prices fall to slightly more than $1 per pound. Collapsing prices across the front half of the bird lowered the weighted broiler cutout value from an average of $1.46 per pound (LEAP Market Analytics estimate) in May 2022 to less than $0.70 per pound coming into November 2022.

Burdensome supply

Accelerating supply growth almost certainly depressed key markets. In the third quarter of 2022, domestic ready-to-cook (RTC) chicken production increased by nearly 3% compared to the same quarter the prior year. It was the largest year-over-year increase in output since the first quarter of 2020.

There should be another substantial production increase in the fourth quarter, too. In the six weeks between mid-September to late October 2022, broiler chick placements were 5% greater than the same period the previous year.

Domestic per capita availability of broiler meat was already at a record high on an annual basis in 2021. It should increase another 3% overall in 2022, extending supply levels deeper into record territory.

Demand crumbles

Higher supplies depress prices, but supply-side forces alone don’t explain such a drastic erosion. Demand softened to the point of collapse.

Seasonality, specifically for boneless, skinless breast meat, typically cools prices as buying interest declines after the summer grilling season. However, the observed shift is well beyond this typical change.

This is a much broader, even cyclical, decline. Demand index readings were perched at record levels between spring 2021 and spring 2022. That was predictably unsustainable. Nevertheless, the speed with which that strength evaporated is breathtaking.

Integrators reeling

With little change in the underlying cost structure since spring, sharply lower product prices are inflicting a financial calamity on integrators.

In early 2022, profit margins were at their highest level in at least four decades. Now, integrators are enduring net losses of more than $0.25 per pound on a RTC basis. Another unsustainable situation that could lead to painful decisions.

A return to restraint on the supply front should lend a bullish assist to broiler markets moving deeper into 2023. But demand is a huge wild card and there’s no guarantee it will shift back in the industry’s favor.

Consumers watched retail prices for boneless, skinless breast meat balloon to a record $4.75 per pound in September 2022, from just $3.52 per pound in September 2021, remain in revolt against inflationary forces. It might take a little while before they’re coaxed out of the trenches.