Confirmation of the similarity between the strains of H5 N1 highly pathogenic avian influenza (AI) strain in Hungary and the UK indicates that poultry-to-poultry transmission was the most likely route for the UK outbreak, according to Fred Landeg, UK Deputy Chief Vet.

Official Hungarian investigations revealed no live poultry sent from the restricted zone to either slaughterhouse since November. This eliminates Hungarian poultrymeat as the transmission vector, says Hungary’s Chief Vet, Miklos Suth. His view is endorsed by the EU but thi sonly adds to the claim by EU officials that the actual transmission route may never be identified.

Hungary and the UK have both suffered a serious outbreak of H5N1 in commercial poultry – the first within the EU for almost a year. Both must deal with the repercussions, made worse by continuing controversy over transmission. What is at risk for these two unlucky members of the EU, with its annual production of 11 million tonnes (mt) of poultrymeat from 1.7 billion birds pecking their way though 20 percent of EU cereal production?

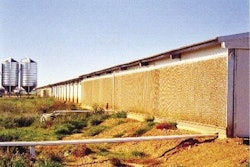

The UK produces 1.6mt of poultrymeat each year. Ninety-four percent of the national flock is chickens and 90 percent of these are reared indoors. In 2005, almost 850 million birds were slaughtered in the country. Some 275,000t of poultrymeat with a value of UK£250 million is exported but 530,000t are imported to satisfy demand. At 28.5kg, UK per-capita consumption of poultrymeat is well above the EU average of 22.9kg.

By comparison, Hungary’s national flock of 41 million broilers is much smaller but more varied with 30 percent poultry that are not chickens. Production and exports are similarly more varied and include chicken exported to Germany, Switzerland, Austria and Italy, while turkey is dispatched to the UK, Netherlands, Switzerland, Italy, Austria and Germany, and ducks and geese are sent to Germany. Specialist exports include over 1500t of foie gras (duck and goose liver pâté) exported to France. Despite its smaller size, the Hungarian industry has more to lose because its annual exports of 120,000t are proportionately larger than the UK. The export base is more varied, with a wider range of customers to ‘upset’ over AI.

When H5N1 infected commercial poultry in France in February last year, home sales slumped by 30 percent and took almost six months to bounce back. Italian markets reacted more violently to a less serious event at the same time – H5N1 was found in wild birds – and sales fell immediately by 70 percent.

According to the Hungarian Poultry Product Council, poultry product sales there are hardly affected, and UK sales are holding up remarkably well considering the extensive and damming press coverage. One leading supermarkets has said that sales of all poultry products fell by just 10 percent at the height of the crisis last week. The main casualty so far has been the Bernard Matthews Brand: the latest reports suggest a halving of normal sales.