Chicken is the meat of the future, say leading commentators. In a presentation to packaging industry conference Packform 2010, Nan-Dirk Mulder of Rabobank International suggested that poultry will have overtaken pork by 2030 as the world’s most popular meat.

The accompanying Chart 1 shows his round-up of forecasts from various agencies on the markets for the main meats up to 2025, emphasising how much poultry meat is expected to gain. It is extracted from his presentation to the 2010 Alltech international symposium held in the USA. Richard Brown of GIRA presented Chart 2 to the 3rd Global Feed & Food Congress, in Mexico, to illustrate expectations of how meat consumption by species in 2015 will compare with levels in 2005. Chart 3 tracing meat consumption per person/year over the period 1999 to 2019 is from projections in 2010 by U.S.-based food policy research institute FAPRI.

Market growth

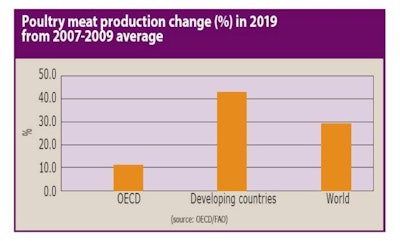

Forecasts have different horizons according to their source. The most widely quoted on livestock products internationally is the annual review of commodity market projections prepared jointly by the Organisation for Economic Cooperation & Development (OECD) and the food/agriculture organization of the United Nations (FAO). The sixth edition of this Agricultural Outlook series looks at prospects up to 2019. It predicts that the annual rate of market growth for all meats will ease slightly from 2.1% per year in the most recent decade to 1.9% in the period 2010-2019, but that poultry meat will be the main beneficiary.

The increases averaging 2.4% per year that it projects for the production and consumption of poultry meat compare with 1.7% projected for pork and 1.5% for beef. Consumption of poultry meat is expected to increase at an annual rate averaging 2.7% in developing-economy countries, but only 1.6% in those with a developed economy.

By this same OECD/FAO assessment, we should expect that world poultry meat consumption per person per year will increase by nearly 2 kilograms (kg) by 2019, from 13.5 kg to 15.3 kg, adding 26 million metric tons to the amount required annually. It says over 91 million metric tons of poultry meat per year were produced as an annual average in 2007-09 and by 2019 this looks likely to rise to almost 118 million metric tons. The details are set out in Table 1.

Areas of increase

Addressing a markets forum at the 2010 International Poultry Expo in the USA, American economist Dr. Paul Aho speculated that world production of poultry meat and eggs could grow from a current level of slightly under 160 million metric tons per year to reach almost 300 million metric tons annually by 2050. Most of the increase, he added, will probably be in middle-income countries in Asia, Eastern Europe, the Middle East and Latin America.

To achieve such a rise would involve doubling the present output of chicken to around 150 million metric tons, with increases of 100% for turkey meat at 10 million metric tons and for eggs at 136 million metric tons.

However, the amount of poultry meat and eggs consumed worldwide is influenced not only by population size and incomes, but also by food prices as governed by the cost of grain used in feeding the birds. Although the better feed conversion ratio achieved by poultry production means it is hit less hard than pork or beef when grains become more expensive, a crisis in the grain sector still could reduce the increases being projected for the uptake of chicken and turkey. Egg consumption tends to be much more resilient, however, making eggs the most sustainable of the animal proteins.

The latest series of long-term projections produced by the U.S. Department of Agriculture (USDA) looks at the likely trend to 2019 and assumes a rebound in global economic growth after recession that will support good gains in world food demand and agricultural trade. But it also points out that stronger economic growth contributes to a continued slowing of population gains around the world as birth rates decline. Its assumption is that the growth in the world’s human population during the period 2010-2019 will average only about 1.1% per year compared with rates averaging 1.7% per year in the 1980s and 1.4% annually in the 1990s.

Again, however, the developing countries provide a particular focus. The USDA analysts say they will generally will have higher population growth rates than in the rest of the world so that their share of world population increases from 78% in the 1980s and 80% in the 1990s to 84% by 2019.

European market researchers have examined the likely scenario for meat markets in Europe up to 2015. Their general conclusion is that the all-Europe production of poultry meat could grow by 8% in this time, with a 9% rise looking possible for consumption in the EU-27 member states.

Other forecasts have considered the outlook for the world trade in poultry meat up to 2019 and decided that these, too, should benefit from a return to better economies. They believe the total annual volume traded could increase by up to 25% from the level recorded in 2010. Brazil is seen as a major beneficiary, possibly adding 35% to the amount it exports each year. From lower starting levels, increases of 46% are projected for China’s exports and of 59% for those from Thailand.

Chart 5 is from a USDA publication indicating how imports of poultry meat by several of the main importing countries may change in the coming years. The region comprising the countries of the Middle East and North Africa is already the largest in the world for annual imports of all meat. The forecasters suggest this dominance is set to grow even more by 2019, not least with regard to the importation of poultry meat.