Download data:

- Poultry meat production by species

- Poultry meat production by region

- Poultry world slaughterings and production by species and region

World production of poultry meat grew only from about from 91.8 million metric tons in 2008 to 92.3 million metric tons in 2009, but the estimate for 2010 is 94.8 million metric tons. This level of output in 2010 would compare with roughly 106 million metric tons of pork and less than 65 million metric tons of beef.

The stagnation of poultry meat production in 2009 was the first instance of a slowdown seen for the sector in recent times. The recovery in 2010 was expected to be greater, but tended to be held back by concerns over feed costs around the middle of the year when the price of grain showed signs of a substantial increase.

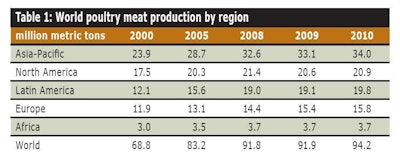

See from Table 1 how regional volumes closely reflected the overall standstill in annual production comparing 2008 and 2009. The global increase of 2.5% from 2009 to 2010 appears again to be spread quite evenly between the regions.

Variations in growth

Early indications for countries with the largest poultry meat sectors gave more variable growth rates, however. China and Brazil were considered to be on course for increases of around 4%, whereas expansion in the USA was put at 2% and that for the EU-27 of Europe no more than about 0.5%.

China is expanding particularly to meet the larger domestic market arising from its economic growth. Brazilian expansion is being driven both by a strong demand for poultry meat at home and an increase in the volume exported.

Even more notable was the potential for a 10.5% rise attributed to Russia’s production of poultry meat in 2010, to fill the gap left by reduced imports and increasing domestic demand. Such growth would take the annual volume from Russian producers to 2.8 million metric tons, driven by economic growth that the World Bank predicted would work out at 4.5% for the annual rise in national GDP.

In fact, the Russian minister of agriculture spoke in 2010 of the possibility that Russia could become a substantial exporter of poultry meat by 2015, capable of selling 400,000 tons per year to other countries. She forecast that national production by 2020 could reach as much as 6.2 million metric tons per year.

Market weight rises

Data from the USA illustrate how rising poultry meat production in 2010 has often been due more to higher market weights for chickens and turkeys than to the number of birds sent to processing plants. For example, the 4.2 billion broilers handled by U.S. plants in the first six months of 2020 represented only a 0.1% increase year on year, but the average weight of the birds at slaughter was up 1.6% at 2.57 kilograms. Similarly with turkeys – although bird numbers were down by 4.5%, there was a 1.3% rise in the average weight per bird.

From a European perspective, the poultry meat market in 2010 had to take account of the mid-year implementation of an EU-27 broiler welfare directive (coded 2007/43/EC) specifying that the stocking density of housing for meat chickens could not exceed 33 kilograms per square meter unless under special circumstances – in which case the limit could increase to a maximum of 39 kg/m2. Revised standards for the marketing of poultry in EU countries were also introduced.

First signs for the EU-27 in 2010 were that member states would produce about 8.7 million metric tons of broiler meat while exporting 770,000 metric tons and importing 720,000 metric tons. Its turkey meat production was put at only slightly under the 2009 total of 1.82 million metric tons, with exports at 105,000 metric tons and imports at 120,000 metric tons.