"It's the economy, stupid" was a phrase in American politics widely used during Bill Clinton's successful 1992 presidential campaign against George H. W. Bush. It has since morphed into many variations (e.g., “it’s the deficit, stupid,” “it’s the voters …” etc.) but at its essence has come to symbolize the need to comprehend and communicate the obvious.

After reaching optimistic heights last quarter, it’s time to face the obvious – rising grain prices will most likely contribute to poorer economic conditions, decreased profits and a more pessimistic poultry industry over the near term.

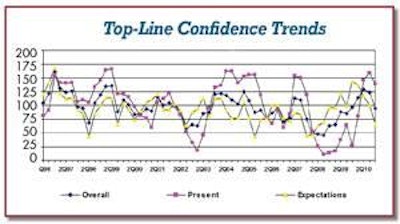

The Poultry Confidence Index, which reached historically-high levels last quarter, declined somewhat but remained at normal levels or slightly above. The Overall Index now stands at 94.5 (1996=100), down from 123.4 last quarter. The Present Situation Index declined to 138.3 from 158.6 while the Expectations Index fell to 65.4 from 99.9.

Expectations are a clear area-of-concern especially as related to future conditions and future profits. These two sub-indices were well below normative levels with quarterly drop-offs of nearly 50% (future conditions fell to 44.3 from 78.9 while future profits fell to 51.6 from 90.1).

Grain prices and the contributing factors

Based on the title of this article, the reader can probably guess the primary culprit for predicted declines in future conditions and profits – rising grain prices! Corn, soybean and wheat prices have been in a steady uptrend since early July with large increases in corn futures. Contributing factors have included less corn acreage, estimates of lower corn yields, ethanol subsidies, poor starts for U.S. winter wheat coupled with declines in Russian supplies and rising demand for vegetable oil worldwide. Furthermore, declining U.S. dollar values and rising energy prices have generated greater demand for U.S. commodities across the globe.

J.P. Morgan analyst Ken Goldman recently commented on this situation in the U.S. in light of October increases in domestic hatchery flocks of 8%. “We are not certain why the chicken industry is increasing the breeder flock at a time when margins are set to be squeezed by higher feed costs.”

Rising consumer confidence

Some respondents balanced these glum predictions against the potential for increased demand within a rising consumer economy.

Lynn Franco, director of the Conference Board Consumer Research Center, provided insights based on its November Consumer Confidence Index: “Consumer confidence is now at its highest level in five months, a welcome sign as we enter the holiday season. Consumers’ assessment of the current state of the economy and job market, while only slightly better than last month, suggests the economy is still expanding.”

Summary. It’s the grain prices! Fortunately, however, current conditions remain strong and we suspect that an improving economy and increasing demand may soften any blows from rising grain prices. Higher production and increased regulations may act as counterweights to hasten declines.

- The Poultry Confidence Index, which reached historically-high levels last quarter, declined somewhat but remained at normal levels or slightly above.

- The Present Situation Index declined to 138.3 from 158.6 while the Expectations Index fell to 65.4 from 99.9.

- Confidence levels among turkey industry respondents plunged dramatically this quarter.