Trying to understand what lies ahead this year for corn prices is no easy task, particularly when one factors in possible exports to China. Earlier this year, the Financial Times forecast China to import the largest amount of corn in nearly 15 years. A month later, Bloomberg, citing the United Nations Food & Agricultural Organization, reported that corn imports by China may total 2 million metric tons in the year to June 30. The Wall Street Journal subsequently reported that exporters had already made deals with China for 116,800 metric tons of corn to be delivered before August 31. On that same day, Reuters reported that a prolonged drought in China could also put pressure on global supplies and raise prices.

For many, it seems only a matter of time before a global battle for limited corn supplies begins. However, despite these reports, not everyone is in agreement as to what will ultimately happen in regard to China, corn exports and corn prices in 2011.

Experts disagree

According to Tom Elam, president, FarmEcon LLC, an agricultural and food industry consulting firm in Carmel, Ind., the China factor in corn is interesting. However, it is not nearly as important as crop size.

“The major question is how large the U.S. corn crop will be – that is the 64 thousand dollar question,” Elam says. “The yield of acreage of U.S. corn will be the dominant factor and influence on price.”

According to Elam, China maintains a pretty substantial supply of “safety stocks.” He believes that China could draw down those stocks or, depending on how high or low prices are here, they could buy from us. “However, I don’t see them very interested in our corn – or anyone’s – at today’s prices."

International poultry economist Paul Aho, who operates a consulting service, Poultry Perspective, in Storrs, Conn., agrees. “The weather is the story when it comes to the supply and price of corn. How much land and what kind of yield we will have are the questions to answer. China is not the big story this year. If we do have a corn problem in 2011, we cannot blame China.”

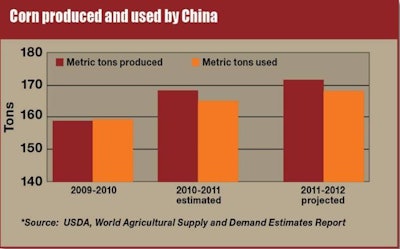

USDA numbers

The USDA’s World Agricultural Supply and Demand Estimates offer the federal government’s assessment of U.S. and world crop supply and demand prospects as well as U.S. prices for the 2011-12 season. The WASDE report released on May 11 revealed that China is actually producing as much corn, or nearly as much, as it uses. In 2009-2010, China produced 158 million metric tons and used 159 million metric tons. In 2010-2011, estimates are 168 million metric tons produced and 164 million metric tons used. This trend should continue in 2011-2012 with projections at 172 million metric tons produced and 168 million metric tons used.

A 52.4 million metric ton increase in global corn output to reach 867.7 million metric tons will account for 84% of the year-to-year increase in coarse grain production in 2010-11. Foreign corn production is projected to increase by 25 million metric tons with the largest increases expected in China, Argentina, Russia, Mexico and the Ukraine, according to the WASDE report.

China’s reserves

Former Risk Management Agency administrator and U.S. Feed Grains Council officer Eldon Gould also places more importance on weather in the Midwest than on the concern over Chinese importing U.S. corn.

“The numbers coming out of China are soft,” he says. “They do not have the credibility of numbers the U.S. puts out. Stocks of grains in China are a state secret. Yet, reports from touring officials indicate that the country has huge grain bins full of wheat and corn. These supplies are pretty substantial,” Gould says.

Gould suggests that one important point to remember in discussing the possibility of China’s corn imports is that China likes to maintain ample reserves so that it is not at the mercy of the market, another reference to the previously mentioned “safety stocks.”

Political motivations

Gould says he suspects that China’s motives for buying or not buying corn are politically motivated. “To keep their domestic prices reasonable, they are not above spreading information to drive prices one way or the other. They are a player in the global economy, the same one in which we are in; however, not everyone plays by the same rules that we do or believes that everyone should.”

Gould also believes that the size of the U.S. corn crop will be the big corn story, together with what impact the weather plays.

Possible reversal ahead

Still, there is no question that the demand for grains in China has been accelerating over the years. Thus far, China’s ability to produce has kept up. How long this will continue remains to be seen.

Elam says that eventually China will have to import more grains or do something to improve the productivity of its land. “Their corn yields are significantly lower than in the U.S.; therefore, they may have some room to expand domestic production as well,” he stated.

China recently announced that it would replace grain with more economical materials in its ethanol production. The move was made in response to concerns over food supplies and the fact that ethanol is competing with production needs. This is a telling move from the nation that is the world’s third-largest ethanol producer, just behind Brazil and the U.S. Until now, China has relied on wheat and corn for its main ethanol feedstock.

Dr. Lester Brown, president of the Earth Policy Institute, believes that China may soon reverse its “self-sufficiency” policy on corn, as it had done previously with soybeans. He believes that China will look to the global market for massive grain supplies. “To import those quantities of grain,” Brown reported, “China will necessarily draw heavily on the United States, far and away the world’s largest grain exporter.”

If this scenario takes place, Brown predicts higher prices “not only for products made from grain, such as bread, pasta and breakfast cereals; but also for meat, milk and eggs, which require much larger quantities of grain to produce.”