Overall confidence levels in the first quarter of 2011 had fallen to near their lowest levels since the Poultry Confidence Index was begun in early 1996. Many respondents were concerned that “future profits would take a major hit.” Although many of the conditions that led to this conclusion – high grain prices, rising fuel costs and expectations of lower prices due to excessive supply – are still with us today, they seem to be weighing less heavily on the industry outlook. Possibly, the resilient poultry industry is now adapting to changing conditions.

PCI rebounds in Q2

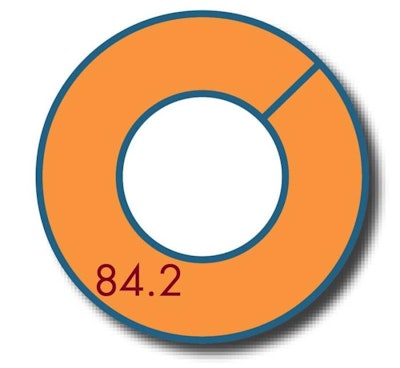

The WATT PoultryUSA/Rennier Associates Poultry Confidence Index rebounded in the second quarter of 2011 to post across-the-board gains for the first time in a number of quarters. The Overall Index now stands at 84.2 (1996=100), up from 65.1 last quarter. The Present Situation Index increased to 91.1 from 74.5. The Expectations Index rose to 79.7 from 58.9.

Although these summary indices were below “normal” or average, the trend is a step in the right direction. This improvement was mirrored in the Consumer Confidence Index. The CCI posted a modest gain in April based on lessened inflationary concerns and an improved assessment of current conditions – a “sign that the economic recovery continues.”

Grain prices the big issue

Grain prices continued to be the big issue in the poultry industry, overshadowing other factors like excessive supply and energy costs. Respondents clearly indicated that the price of corn and soybeans was substantially more important to their future business outlook than factors like the general economy, energy costs and industry production levels. Regulatory burdens and exports were distant concerns for most.

Respondents yearned for an improvement in planting numbers, yields and a good harvest. They placed substantial blame on ethanol programs for artificially raising the price of corn. Many called for a cutback or repeal of incentive programs by Congress, or at least an honest discussion of its impact on the protein industries.

No big improvement in grain prices foreseen

Finally, nearly half of the respondents said there was “little or no chance” that the price of corn or soybeans would “make a turn for the better in 2011.” Only one in eight was optimistic that grain prices would improve in 2011.

Summary

Expectations that grain prices will remain high throughout 2011 will dampen future industry confidence even though an improved general economy, stabilized fuel prices and potentially less supply were neutral-to-positive factors. For now, grain prices are too high and have such an inordinate impact on the bottom line that all other factors pale in comparison.