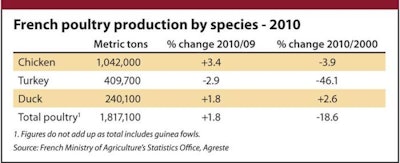

French poultry production recovered slightly in 2010, by 1.8% to 1.8 million metric tons, compared with the previous year, when production was down by 4.1%. Chicken production grew by 3.4% to 1.04 million mt, with duck production also up by 1.8%. Production of turkey, however, was down by 2.9%.

The total number of birds slaughtered grew by 2.3% to 943.3 million head. By the end of the first quarter of 2011 this figure was up by 4% on the same period in 2010, with the number of chicken and ducks slaughtered up by 7% and 5%, respectively. The number of turkeys slaughtered has continued to decline.

Exports to developing world and Middle East buoyant

Growth in production was fuelled largely by exports of chicken meat to the developing world. Across poultry meat, demand from the developing world increased by 8%, helping drive an overall increase in French poultry exports of 3.4% to 624,400 mt. Poultry meat exports to the Middle East were up by 17% to 191 million mt, but exports to Russia plummeted by 41% to 28 million mt. Within the EU, exports remained stable at almost 191 million mt but were down to the UK.

Frozen chicken meat fared particularly well in the export market, most notably to the Middle East, where exports were up by 17% in volume and 40% in value terms. Exports of frozen chicken cuts off the bone were in particular demand from Spain, Belgium and Russia.

Exports to the developing world and Middle East have remained buoyant in the first quarter of 2011. Exports of chicken meat and products to the developing world accounted for 32% of chicken slaughtered in the first three months of 2011 – up by 26.5% on the same period of 2010. Exports of cut, frozen chicken almost doubled to Sub-Saharan Africa, compared with the first quarter of 2010, and frozen chicken carcasses were up by 36% to Saudi Arabia during the same period.

Meanwhile in Europe, demand for frozen cut chicken has been strong in the first quarter of 2011, with an increase in both volume and value terms of 16.5% on the same period last year.

Notably, exports of turkey meat and products to the developing world also recovered in the first quarter of this year, following a 10% decline in 2010. However, an 18% decline in volume exports to the EU meant overall turkey meat exports were slightly down on 2009.

Rising imports

Export gains aside, the downward trend of declining exports to the EU and rising imports continues to put the industry under strain. Imports of poultry meat and products were up by 8.1% in 2010 to 449 million mt, with imports of chicken up by 9.7%. Developing world net poultry exports have fallen from 370 million mt in 1998 to 308 million mt in 2010. More dramatic is the downward trend in foreign trade within the EU. EU imports were up 11% to 270 million mt in 2010, leaving France a net importer of 134 million mt of poultry carcasses from the EU – a deficit that has been growing for the past three years. In 1997, France was a net exporter of 365 million mt to the EU.

Declining trade surplus

France managed to maintain a trade surplus in value terms in 2010, but at €387 million it is significantly lower than the €706 million trade surplus it recorded in 2005. The trend is continuing in 2011, with the EU trade surplus reducing by a further €34 million during the first quarter of 2011.

Domestic consumption

Imports (at 40%) were the main beneficiary of an increase in domestic consumption of poultry meat, which was up 4.3% in 2010 compared with the previous year. The rise follows a fall in consumption of 1.8% in 2009 and was fuelled by a 3.6% growth in consumption of chicken, with purchases up by 7%. Growth is being driven primarily by purchases of whole standard chickens and chicken cuts, where prices are falling, according to Kantar Worldpanel. Purchases of processed chicken products are again on the increase, up 8.3% on 2009.

Turkey and duck meat also saw increases in consumption, of 7.3% and 0.9%, respectively. According to Kantar, purchases of turkey products were up by 1.6% after several consecutive years of decline. Purchases of duck products were up by 2.7% in volume, despite strong price increases.

At 24.7 kg per capita, annual poultry consumption accounts for 28% of overall meat consumption in France, ranking third after pork and beef. Chicken consumption has seen strong growth over the past decade, now representing 60% of total poultry consumption, while demand for beef and pork has been declining slightly.