A recent editorial in the New York Times called for the federal government to “Break Up Big Chicken.” The author, Binyamin Appelbaum, states that President Joe Biden “wants to lead a revival of antitrust enforcement, a campaign aimed mostly at curbing the behavior of feral tech companies.”

Appelbaum then issues a call to action for President Biden, “But Mr. Biden can’t achieve his goal of expanding fair competition in the United States solely by wrangling with Big Tech. To succeed, he’ll need to confront Big Chicken, too.”

He explains the need for possible regulatory action by saying, “Most chicken that Americans eat is processed by a handful of big companies because, in recent decades, the government gave its blessing to the consolidation of poultry processing, along with a wide range of other industries.”

The proposed Sanderson Farms and Wayne Farms merger is drawing the scrutiny of some members of Congress. In a letter to the Justice Department dated August 10, 2021, U.S. Senator Charles Grassley said that combining Sanderson with Wayne Farms, a subsidiary of Continental Grain, would give the combined entity 15% of the U.S. chicken market.

"I am concerned that continued mergers and acquisitions in an already concentrated poultry industry will increase consolidation, frustrate competition and reduce marketing options," he wrote. "I also am concerned about the impact on consumer choice and price of poultry products."

The facts, however, don’t support the proposition that there has been significant concentration of broiler processing companies in the U.S. this century. In fact, even if the Sanderson Farms and Wayne Farms merger takes place, the U.S. broiler industry will be slightly less concentrated after the merger than it was in 2006 after Pilgrim’s Pride purchased Gold Kist.

Concentration calculations

WATT Global Media has been conducting an annual Top Company Survey of the U.S. broiler processors for decades. This survey has become the published resource for rankings of the industry. The key measurement for ranking U.S. broiler firms is the company's weekly ready-to-cook volume it produces. We have used this data to calculate the relative level of concentration of the U.S. broiler industry this century.

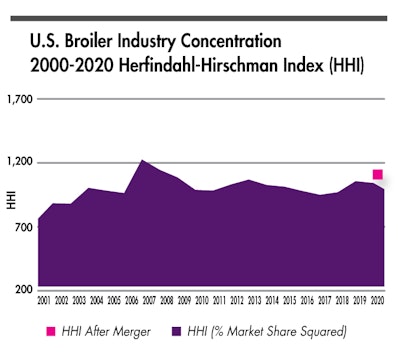

According to the Library of Economics and Liberty, “Industrial concentration was traditionally summarized by the concentration ratio, which simply adds the market shares of an industry’s four, eight, twenty, or fifty largest companies. In 1982, when new federal merger guidelines were issued, the Herfindahl-Hirschman Index (HHI) became the standard measure of industrial concentration." The HHI is calculated by summing the squared market shares of all of the firms in the industry.

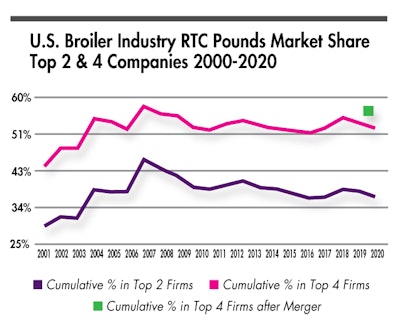

Since 2000, the market share for the four largest broiler processors in the U.S. has ranged from a low of 43.7% in 2000 to a high of 57.8% in 2006. Adding the combined volumes of Sanderson Farms, currently the third largest firm, and Wayne Farms, the industry’s seventh largest firm, reported in the 2021 survey, which is based on 2020 volumes, the top four companies (Tyson, Pilgrim’s, Wayne/Sanderson, Mountaire) would represent 57.6% of the industry’s total output.

The HHI calculations for U.S. broiler processors this century range from a low of 755 in 2000 to a high of 1,217 in 2006. The HHI for the U.S. broiler industry after the proposed Sanderson and Wayne Farms merger is completed would be 1,080. Barring any other merger activity in the coming months, the U.S. broiler industry will be slightly less concentrated, if the Sanderson/Wayne merger takes place, than it was 15 years ago.

When is an industry “concentrated?”

According to the U.S. Department of Justice's website, “The agencies generally consider markets in which the HHI is between 1,500 and 2,500 points to be moderately concentrated, and consider markets in which the HHI is in excess of 2,500 points to be highly concentrated.” The HHI for the U.S. broiler industry hasn’t approached 1,500 at any time this century.

Using the U.S. Department of Justice website as our guide, the U.S. broiler industry isn’t even moderately concentrated. Is the “Big Chicken” label even appropriate? I don’t think so, but activist groups like to portray “big” as “bad,” so they are quick to characterize industry players as “big.”

The U.S. broiler industry continues to be highly competitive, efficiently utilize resources and provide the lowest price of meat for U.S. consumers. I think that regulators’ and trust busters’ time would be better spent looking at other industries.

Why isn’t the U.S. broiler industry more concentrated?

Since 2003, either Tyson or Pilgrim’s has been the largest broiler processor in the U.S. and the other has been the second largest. The combined market share of the two companies peaked in 2006 at 45.4%, after Pilgrim’s bought Gold Kist. The combined market share of the industry’s two largest companies has declined to 36.8% today. Since 2006, the rest of the U.S. broiler industry has grown at a much faster rate than the industry’s top two players. The combined weekly ready-to-cook volume of Tyson and Pilgrim’s has only grown 8.6% from 333.8 to 362.4 million pounds in 2006 and 2020, respectively. While at the same time, the rest of the industry increased production 55.3% from 400.8 to 622.4 million pounds in 2006 and 2020, respectively.

There have been a number of acquisitions in the U.S. broiler industry this century and the number of firms in the Top Company Survey has declined from a high of 46 in 2000 to a low of 29 in 2018. The number of firms has rebounded to 31 this year but would fall back to 30 after the Sanderson/Wayne merger.