The market for poultry meat and eggs over the coming decade will be largely influenced on the supply side by high input costs, animal disease and tougher regulations. On the demand side, although the world’s population growth percentage is expected to slow over the outlook period to 2023, an overall higher population, changing diet preferences and rising incomes will help to boost consumption of poultry meat and eggs.

While growth will be slower compared to the previous period, production of poultry meat will overtake pig meat by the end of the decade. Compared to some other meats, poultry producers have an advantage of not requiring as large of a land base, thus making production possible near urban areas; having a shorter production cycle; and having a high feed conversion ratio that is among the lowest production costs of all meats. Long-run trend estimates by the Food and Agriculture Organization (FAO) suggest that poultry meat to feed price ratios will fall over the outlook period by 0.8 percent per year. FAO projections show that in the medium term, farm price to feed price ratios will remain at or above trend levels due to higher input costs.

Disease control continues as challenge for Asian poultry producers

While these benefits help to stimulate production growth, particularly in developing regions, poultry producers will continue to face challenges with diseases spreading, especially in higher-density operations. Asia, remaining the world’s fastest growing market for poultry meat, will continue to be challenged with resolving such disease issues; notably, China’s production will recover over the outlook period if outbreaks of H7N9 avian influenza are controlled and consumers regain confidence in the safety of the country’s poultry meat.

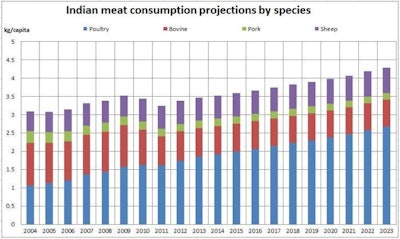

Poultry meat consumption over the outlook period will be aided by the fact that it is free of the cultural barriers that affect pig meat and is the cheapest and most accessible meat, according to FAO. Poultry prices will follow feed costs over the outlook period, forecast to reach US$1,550 per metric ton by 2023. Poultry meat consumption will lead growth compared to consumption of other meats, increasing by 27 percent in 2023 relative to the base period 2011-13. Consumption growth in developed economies is projected to remain slow, while developing economies will comprise much of the demand.

A further look at the forecast for international meat markets shows meat trade expansion is forecast to grow at a slower pace from 2014-23 than in the previous decade as a result of greater domestic production in developing and least-developed countries, which have historically been importers. Most of the additional meat traded is poultry meat, accounting for just over half of additional trade through the outlook period, followed by beef and pork, according to FAO projections.