Russia's accession to the World Trade Organization (WTO) in August 2012 has seriously complicated the work of the domestic feed industry, which now has to face tough competition with foreign producers, according to the Russian Union of Feed Producers. With the increase of imports, Russian feed producers have no choice but to seek a way to improve the efficiency of the work of their enterprises.

"The problem is that foreign companies supplied Russia with a lot of raw materials, biologically active substances and meals," commented Valery Afanasiev, who heads the Union. "Our analogs typically are cost by 20 to 30 percent higher so it is very difficult to compete in such situations even though the quality of our products is comparable and often exceeds international standards."

According to Afanasiev, the Russian feed industry needs a comprehensive development program to ensure its growth and development. This type of planning will also protect it from acquisitions by foreign businesses.

The Russian government is working on the industry development program, which is crucial for the future of all feed producers in the country. If the program is finally adopted, Russia may increase feed production from 27 million metric tons to 40 million metric tons by 2020, according to estimates of the Union of Feed Producers.

Development program

According to official statistics, in 2012, the production of animal feed in the Russian Federation amounted to 20 million metric tons; however, the Union estimates the real output at the level of 26 to 28 million metric tons taking into the account the volume of the shadow market. Initial estimations show that by 2015, the production of animal feed may reach 34 to 35 million metric tons.

It is assumed that the program will provide certain mechanisms to support feed producers, including direct subsidizes and preferential loans' conditions for the projects of creating new feed mills or expanding the capacities of already-operating enterprises. Thus, the industry program will be supported by the government in the same ways as programs for the poultry and pig industries.

In the opinion of Union, the program may be adopted in 2014 and will bring an almost immediate effect in increasing the number of investment projects in the area of feed production. During the past five years, 40 new feed mills have opened in Russia. According to industry experts, with the adoption of the program, this figure may triple during the coming five years. Furthermore, the industry has good potential for additional growth. In 2020, for example, the demand for feed production in the Russian market will be about 45 million tons.

At the same time, the Russian Union of Feed Producers warns of the steadily growing volume of foreign-supplied feed. Foreign businesses, primarily from Europe, have been actively investing in the development of the Russian feed industry. With the opening of the market after the WTO accession, foreign expansion could become more active.

Foreign investments

To date, the volume of foreign capital in the Russian feed industry is not very large, but it is growing. According to forecasts, outside entities will control a significant part of the market during the coming seven years.

"In terms of feed additives, many of our manufacturing plants are owned wholly or partly by foreign companies, so it is often hard to say who the 'domestic producer' is," says Liliya Alexandrova, the chief editor of Soya News, a feed industry-focused Russian media. "For example, regarding vitamins and some other compound feed ingredients, we are not making them at all. Joining the WTO may complicate the development of our own production of vitamins, enzymes, amino acids, etc. But from my point of view, this is not so much the issue of WTO, but the issues of the state policy in the area of agriculture."

This view was shared by Elena Klenkina, head of marketing, Provimi-Russia, which controls about 7 percent of the country's animal feed market: "The market of animal feed, concentrates and additives will continue to develop through modernization and construction of the feed mills, including by the major agricultural holdings. However, whose money will this be - Russian or foreign investors - is another question."

According to the experts' estimations, foreign capital produces about 13 percent of animal feed and 47 percent of Russian feed additives and premixes. It is predicted that by 2020, the share of foreign capital in the animal feed industry will reach 25 percent, and 52 percent for feed additives and premixes. Also, until 2020, several vitamins and amino acids production projects will be implemented by Russian and foreign companies; the share of foreign capital in this segment is projected to range from 30 to 40 percent.

Increasing efficiency

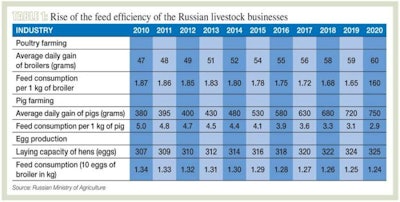

In the opinion of analysts, WTO accession may provide an impetus to the improvement of the efficiency of feed use in Russia. According to forecasts of the Ministry of Agriculture, based on the foreign experience, in coming years, Russian livestock producers will significantly improve the figures of feed spends in all sectors of livestock business (Table 1).

According to Afanasiev: "In regards to the technology of meat and poultry production, [Russians operate] a little differently than Western manufacturers. As for the domestic feed, here we have very large percentage of raw grain in the feed composition. European feed is no more than 45 percent of total production; while in the structure of Russian feed grains, we still have 70 to 75 percent."

"The share of oilcakes, however, in Russian feed is three to four times lower than in imported analogues," he adds. "This defines one of the major challenges of Russian feed industry - high sensitivity to changes in the grain industry."

In Russia, it is necessary to change the situation on the sector of raw materials, Afanasiev says. The country has an abundance of feed grains, but at the same time a shortage of other crops, such as vegetable protein sources, pea, soybean and rapeseed. Stimulation of their production through the program of industry development will contribute to an improvement in the efficiency of feed resources used.

"Joining the WTO in long-term trend will have very positive impact on the livestock industry in Russia -- as the projected growth of the efficiency will significantly reduce the cost of animal feed in the domestic market," report representatives of the Department of Animal Feed in the Ministry of Agriculture. "At present, Russia has a huge potential to reduce the cost of feed, and as we have become much more interesting for foreign companies and professionals, we are certainly able to realize this potential."