The Brazilian feed industry was affected by the turmoil in the world economy last year just like any other sector, say Ariovaldo Zani, CEO of the Brazilian Feed Industry Association Sindiracoes.

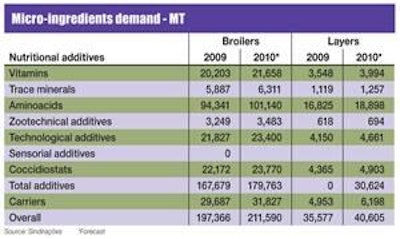

Demand for all micro-ingredients is expected to be higher this year.

The performance of the sector was in marked contrast to that recorded in 2008. Last year saw total production fall to 58.4 million mt, a decrease of 5%, whereas 2008 saw production expand by 10% to reach some 58.7 million mt, with increased demand coming from all livestock sectors. Despite a strong performance for 2008 as a whole, the 2009 downturn was already becoming evident as 2008 began to draw to a close.

From January to September, demand for feed in Brazil rocketed, achieving a growth rate touching on 17%, yet from September to December 2008, demand fell sharply as the effects of the credit crunch began to be felt.

This contraction in demand continued into 2009. During the first quarter, feed production fell by 15% in comparison with the same quarter the year before, and declined by 20% in comparison with the last quarter of 2008. Despite this contraction, there were hopes early in the year that total output could have been some 5% higher.

Mr Zani points out that reduced consumer expenditure resulted in less consumption of animal protein. This had an impact along the entire production chain, affecting fertilizer suppliers, agrochemical and seed suppliers, along with animal nutrition suppliers, livestock producers, exporters and food retailers.

Poultry the exception

Poultry feed production accounts for 55% of total feed output in Brazil and this segment fared less badly than others. Feed for broilers increased by 0.7% last year, to stand at 27.8 million mt. Sindiracoes notes that the number of broilers in the country last year remained more or less stable, which fed through into this small expansion in demand.

Demand for layer feed, however, fared better. Layers consumed 4.82 million mt, an increase of 4.2% on 2008, and this growth was due to an expansion in the country’s laying flock. The second half of the year proved stronger than the first, and at six months into 2008, demand was only 1% higher. As a result of this increase in bird numbers, however, the price of eggs fell back during the first half of the year, and stayed low for the remainder of the year.

Sindiracoes is reasonably confident that the sector will expand this year, forecasting that total demand for feed and petfood could expand by some 3.5%. Nevertheless, there remain factors that could act as a drag on demand, and, clearly, the fortunes of the feed industry are tied to those of the poultry industry.

Stable poultry production

Poultry production in Brazil coped well with the economic crisis. Estimates made at the end of last year by the Uniao Brasileira de Avicultra (UBA) put the total produced at 10.962 million mt, ie more or less the same as the record set in 2008.

Per capita chicken consumption was thought to similarly be at the same level as 2008, coming in at 38.9 kg.

Ariel Mendez, president of UBA, notes that there were still difficulties in winning credit and that, at the height of the crisis, resources simply disappeared. However, with the problems of 2009 behind it, the Brazilian industry hopes to achieve the same level of production this year as last.

The poultry industry continues to dominate the Brazilian feed market.

“We know that the year ahead will be one where the economy recovers, and it is exactly for this reason that that the poultry sector must proceed with caution. It is likely that we will achieve the same production levels as last year,” he says.

The association notes that the activities of pressure groups are increasing, that the currency is over-valued, and uncertainty surrounds the forthcoming presidential elections. In addition, any upturn in economic activity could result in a rise in inflation.

Overall demand for poultry feed this year, could be in the region of 2%, but longer term the outlook is more positive. Mr Zani points out that the Food and Agriculture Organization (FAO) forecasts that the world population will be more than 9 billion by 2050 and that the amount of food produced will need to double. Poultry meat production could increase by some 120%.

He continues that while small increases in production can be met through using more land and increasing crop yields, 70% of this increase will have to be met through technological advances.

Overcoming difficulties

One of the great challenges facing animal producers, he notes, is reducing the length of time that it takes to rear an animal to slaughter using practices that do not damage the long-term future of food production.

The feed industry is helping to meet these challenges through offering alternatives and ever more specific products, and additives that can improve performance while minimizing waste.

Additionally, the feed industry has been offering feed programmes to poultry producers, for example mathematical modeling using non-linear programming rather than least-cost formulations, and has also been helping to improve performance and profitability through additives.

The Brazilian economy grew at its fastest rate in at least 14 years in the first three months of this year. Gross domestic product (GDP) rose by 9% compared with the same period a year earlier. This growth has largely been driven by internal demand and could well lead to inflation pressures that have been feared.

Of comfort to poultry producers, however, is that, despite the small increase in demand forecast for poultry feed, the price of poultry feed is expected to be stable for the remainder of the year.