The future cage-free egg purchase pledges made by foodservice and retail outlets, many of them made a decade ago, are coming due in 2025-26. It is still uncertain what the full impact of these pledges will be on demand for cage-free eggs.

Demand for cage-free eggs and egg products in the U.S. is expected to increase during the next few years. In addition to the cage-free purchase pledges, legislation mandates cage-free egg sales in Nevada and Oregon in 2024; in Michigan, Utah and Arizona in 2025; and Rhode Island on July 1, 2026.

2025-26 cage-free egg market

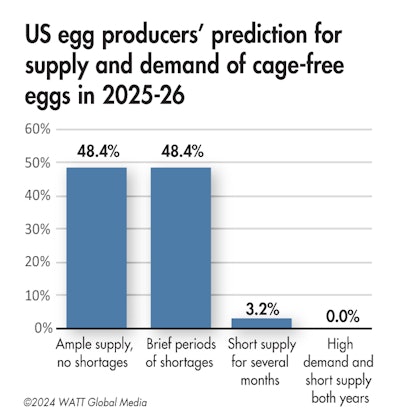

Egg producers were asked which statement they thought would best characterize the U.S. market for cage-free eggs in 2025 and 2026. Of the 31 responses to this question, 15 expect there to be “an ample supply with no shortages,” 15 expect there to be “brief periods of shortages,” one respondent expects “a short supply for several months” (Figure 1). No respondents expect there to be a “high demand and short supply” of cage-free eggs both years.

Figure 1

Figure 1

Cage-free hen housing predictions

The December 1, 2023, the U.S. Department of Agriculture (USDA) Cage-Free Shell Egg Report estimates that in November 2023, the total U.S. cage-free layer flock had 125.1 million hens, an 18.3 million head increase from the same month in 2023. The U.S. cage-free hen flock, which includes approximately 18.9 million organic layers, now make up 38.8% of the total U.S. table egg laying flock. The total U.S. table egg layer flock on November 1, 2023, was estimated by the USDA at 322.3 million hens, up 4.3% from the same date in 2022, as the industry recovered from large losses from highly pathogenic avian influenza (HPAI) in 2022.

State cage-free layer housing mandates and most future cage-free egg purchase pledges have implementation dates by January 2025. Egg Industry’s Annual Top Egg Company Survey has asked major U.S. egg producers how they think the nation’s hens will be housed in 2025 each year since the 2015 survey. U.S. egg producers predict more than half of the nation’s hens will still be housed in cages in 2025 (Figure 2). The simple average of the 29 responses to this question was that U.S. hens would be housed 46.2% cage free and 53.8% in cages in 2025 (Figure 3). For this prediction to be realized, additional cage-free housing for approximately 24 million hens would need to be constructed or converted by the end of 2025.

Figure 2

Figure 2

Figure 3

Figure 3

The combination of legislation in states that have passed cage-free hen housing mandates and future cage-free egg purchase pledges by major egg purchasing companies, if all are honored, would require for approximately two-thirds of U.S. hens to be housed cage free from 2025 on, according to USDA estimates. This level of cage-free house construction or conversion will not take place by 2025 due to uncertainty that purchase pledges will be honored and the negative impact this has on availability of financing for conversion or new construction and the amount of time it takes to complete these projects and populate the houses with hens.

Figure 4

Figure 4

Egg producers were asked to predict how the nation’s laying hen flock would be housed in 2030. The U.S. Census Bureau estimates that the country’s human population will be 345 million in 2030. If we assume that per capita egg consumption and egg exports and imports remain unchanged from current levels, the total U.S. table egg layer flock based on USDA estimates in 2030 would need to be 332 million hens. The simple average of the 29 responses was that U.S. laying hens would be housed 58.4% cage free and 41.6% in cages in 2030 (Figure 4). If this prediction is correct, the U.S. cage-free layer flock would total just over 194 million hens – a 69 million hen increase from today. The simple average of the responses to this question in last year’s survey was 62% cage free and 38% in cages in 2030.

Egg producers were also asked to predict how their own company’s hens would be housed in 2030. The 29 responses to this question were compiled as a weighted average based on the company’s current total number of hens housed. Egg producers predict that their own hens will be housed 32.1% in cages, 64.5% cage free and 3.4% free range in 2030 (Figure 5).

Figure 5

Figure 5

U.S. egg producers were asked if they thought the country’s hens would be housed 100% cage free in 2040. Twenty-seven of the 31 respondents (87%) to this question said no, there will be some laying hens housed in cages in 2040 (Figure 6).

Figure 6

Figure 6

Figure 7

Figure 7

Figure 7

Figure 7

New construction and cage-free conversions

Seventeen of the 29 Top Egg Company survey respondents report building new housing for cage-free hens without outdoor access in 2023 (Figure 7). One company reported adding cage-free housing with outdoor access in 2023 (Figure 8). Fourteen companies report they closed or tore down cage housing for hens in 2023 (Figure 9).

Figure 8

Figure 8

Figure 9

Figure 9

In 2024, 21 of the survey respondents expect to add housing for cage-free hens without outdoor access and five will add housing for hens with outdoor access (Figures 10 and 11). Twelve of the survey respondents report they will close or tear down cage housing for hens in 2024 (Figure 12).

Impact of HPAI on cage-free conversions

U.S. egg producers have tightened biosecurity measures because of HPAI. Restricting movement of people, materials and equipment onto farms is great for biosecurity, but it could also slow any construction work on existing laying farms. Egg producers were asked to select the statement that best described how HPAI has affected the addition or conversion of housing to cage free on their farms. Of the 29 responses to this question, 23 said that HPAI did not affect keeping cage-free projects on schedule, five said projects were delayed for several months and one said projects are now more than one year behind the original schedule (Figure 13).

About the survey

The Top Egg Company survey is conducted annually by WATT Global Media, and the results reported are comprised of a combination of company-submitted information and estimates made based on input from publicly reported information and industry sources. A total of 35 egg producers who own or contract the production of 242.53 million hens responded to the survey and only responses submitted by egg producers are reported in this article. The Top Company Survey estimates that the 63 largest U.S. egg producers housed 338.10 million hens on December 31, 2023. Egg producers’ responses may not reflect all hen losses due to HPAI outbreaks occurring in November and December 2023.

Figure 10

Figure 10

Figure 11

Figure 11

Figure 12

Figure 12

Figure 13

Figure 13