This year's survey of Latin America’s top poultry companies presents more complete data on poultry production for Latin America than ever before, due to the invaluable help of the many poultry companies and associations that provided support.

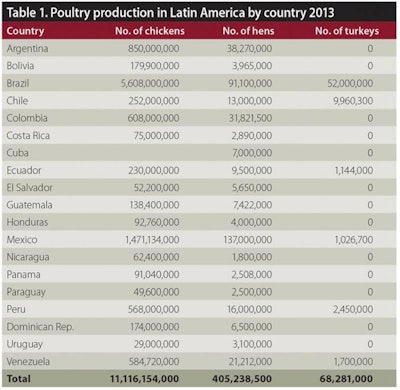

The Latin American poultry industry had an unremarkable year. Beset by high raw material costs early on, and low growth rates in the two largest economies, Brazil and Mexico, chicken production fell from 11.4 billion to 11.1 billion head, a 2.6 percent reduction. Some countries achieved small increases that did not affect the total figure for the region. Brazil was the country that, according to our information, witnessed the sharpest decrease, moving down from 5.9 billion to 5.6 billion head per year (see Table 1).

In egg production, there was an increase of about 1.9 percent in the hen population, from 397.4 million layers in production to 404.7 million (see also Table 1). However, Mexico showed a fall in its domestic laying hen population of more than 4 percent, as a result of the avian influenza outbreak, although it is now on the road to recovery.

Table 2 shows that consumption of poultry products also suffered.

Brazil, for instance, had a sharp decline in reported chicken consumption. Last year, we reported per capita consumption of 47.4 kg. However, the Brazilian Animal Protein Association reports that this figure has fallen to 41.8 kg. Venezuela continues to lead chicken consumption with 46 kg per person, but how long this will last remains to be seen, given the food shortages that the country has been experiencing.

In Mexico, egg consumption remained broadly the same, lifting slightly from 347 to 350 units per capita, and keeping the country in to global top position as far as per capita egg consumption is concerned. This could have been a result of the rapid recovery in the industry and the temporary imports from the US acting to to level off consumer prices and maintain consumption.

Tables 3 and 4 show the top 10 broiler and layer companies in Latin America.

Brazil continues to be the leader in broiler production in Latin America - and the whole world - and one in every two chickens in Latin America is produced in this country. There are some clear changes that can be observed, for example, the merging of companies in Brazil. Over time, there has also been variation in the data received. In this regard, it is worth remembering that we depend exclusively on the information provided and variations may seem obvious, depending on the source.

In egg production (Table 4), Mexico is the leader. Six out of the top 10 companies are located on this country.

This year, there could be surprises that will have national and regional impacts on production. An example would be Venezuela and its shortage of foodstuffs in general, while another would be the oversupply in Uruguay, which exported to the former but suspended sales due to lack of payment, and this will affect its small domestic market.

Other possible surprises could emerge in Colombia, if the industry there starts to consolidate. Compared with production in other Latin American countries, the poultry sector in Colombia remains highly fragmented.

The Central American poultry industry continues its way, perhaps without making much noise, but steadily, with many companies that impress with their professionalism and approach to marketing.

Brazil, Mexico and Argentina will continue to lead the way, but much will depend on how these two countries perform in the macroeconomic arena.