Egg Industry conducts an annual opinion survey to assess the level of confidence among producers and to discern short-term future trends. These are influenced by regulatory, cost and market factors which will affect profitability in the coming year. The 2011 survey represented a cross section of production volumes, shell egg and breaking operations and geographic spread.

The responses provided have been analyzed and interpreted to establish a sense of where we as an industry are headed.

2010 in overview

Salmonella enteritidis outbreak and recall

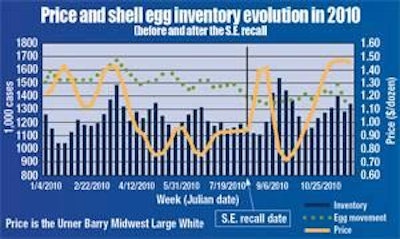

Most producers would rather have passed over August and September of 2010. The dominant event was undoubtedly the double blow of the advent of the FDA Final Rule in July followed by the mid-August SE recall. The roller coaster fluctuation in prices as detailed in the monthly statistical reviews in Egg Industry documented the initial early September rise from approximately 90 cents per dozen to 145 cents as fear of shortages bid up the price. This was followed almost immediately by a precipitous drop to 75 cents as consumer resistance occurred as a result of inflammatory media reports stimulated by injudicious and premature releases by the FDA.

It is estimated that the industry segment producing generic shell eggs from 165 million hens lost over $100 million in the 6 weeks following the announcement of the recall. Fortunately prices rose to forecast levels to attain between 140 and 150 cents per dozen by mid-November. This was attributed to the fact that incident cases of SE associated with the outbreak ceased following FDA sanctions on the index farm, positive publicity generated by the AEB and UEP, the short attention span of the media and their preoccupation with the election, economic issues and then disclosures by WikiLeaks. The fact that up to 4 million hens may have been depleted and the output of an additional 2 million hens was diverted to breaking obviously created a disequilibrium between supply and demand, notwithstanding the decline in consumption. Egg purchases should increase in coming months providing that there are no more SE recalls and with an improvement in the domestic economy although new pullets will be housed and molted flocks will be back in production.

Feed cost

The approximately 20% progressive increase in feed cost during 2010, which was largely overshadowed in significance by SE considerations, added 6 cents per dozen to production cost. The diversion of corn to ethanol, foreign demand for commodities which put pressure on corn and soy in 2010 will continue in 2011 as ex-farm prices forecast by USDA suggest continuing high feed costs.

Welfare

The “Ohio Compromise,” the “Michigan Concession” and individual state Animal Welfare Board legislation seemed to move welfare to the back burner in 2010. The question of California Proposition 2 will in all probability be raised in the courts as to what precisely was meant by the voters’ initiative. The HSUS was impacted by the financial revelations disclosed on humanewatch.org. This activity may have reduced the $100 million annual inflow to the organization’s coffers.

Antitrust allegations

The allegations of antitrust activities remain sub judice although one large producer has negotiated a settlement. The outcome of this issue may have profound implications of how the industry interacts through the UEP and producer cooperatives. It is hoped that the action will be resolved since ongoing legal expenses to defend the allegation are considerable.

The 2010 industry survey

Projections of expansion by respondents overwhelmingly considered that the national flock would remain at 290 million through December 2011. The range of those forecasting changes extended from minus 3 million to plus 10 million suggesting consensus on the restraint in expansion. The survey was in large part completed before the effect of the FDA Final Rule was realized. It is possible that there will be a net decrease in total numbers of hens as individual flocks placed on infected complexes are diagnosed with SE at the first mandatory assay at 45 weeks of age.

Respondents were equally divided on where expansion will occur and whether additional hens would be housed by erecting new housing or re-caging high-rise units. A number of responses suggested that “enrichable cages” would be either considered or installed. It is noted that the American Humane Association will certify European-style “Enriched Cage Modules.” Uncertainty by respondents is attributed to lack of direction concerning future welfare legislation and possible voter initiatives. Resolving the actual meaning of Proposition 2 would be beneficial to the industry as decisions must be made as to the location of complexes and the type of housing required.

Only limited expansion of non-confined housing was contemplated by respondents. Those companies intending to use other than conventional cages favored aviary systems presumably due to high floor stocking density and the relatively lower capital cost per hen housed compared to conventional slat and litter systems.

The adoption of vaccination against SE was a universal response. Virtually all producers now administer 2 to 3 doses of live mutant vaccine to young pullets followed by an inactivated emulsion prior to transfer to laying houses.

Respondents were divided on the effect of the FDA Final Rule and the August recall on future consumption. Most considered that there would not be a long-term decline although some larger producers were of the opinion that there would be a lasting effect, especially on generic sales. Virtually all respondents anticipate an increase in the proportion of breaking. This may be due to in part to increased food service demand and inevitable diversion from SE positive flocks during the coming year.

“Hot-button” issues were scored by respondents on a scale of 0 to 5 with zero as inconsequential increasing to a score of 5 representing extreme importance. The average values for the 10 factors were:

- Welfare restrictions 3.9

- Environmental restraints 3.0

- Feed cost 4.6

- Fuel cost 2.8

- Packaging cost 2.8

- Flock health issues 3.3

- Value of eggs to consumers 3.6

- Federal and state regulations 4.1

- Supply-demand considerations 4.7

- GIPSA regulations 2.2

- FDA Final Rule 4.1

It is noted that respondents committed to breaking naturally were not concerned with either the cost of packaging or the FDA final rule. Since most egg producers operate their own facilities, GIPSA regulations, currently in contention in the broiler industry, are not of concern to other than respondents using contract production. An average value of 11% was provided for the escalation in the cost of feed through 2011.

In considering the effect of welfare regulations and legislation on the location of facilities over the proximal five years the respondents scored alternatives on a scale of zero to ten with increasing impact as follows:

- Decreased egg production in California 9.3

- Decreased egg production in Michigan 5.6

- Decreased egg production in Ohio 3.1

- Increased egg production in the Midwest 3.1

- Increased egg production in the Southeast 4.8

- Increased consolidation in the industry 4.8

- Increase in non-confined systems 4.3

The overwhelming response indicated an anticipated reduction in production from California, currently at 7% of U.S. volume.

Most respondents considered that the price for generic shell eggs would “remain the same” in 2011 with a few forecasting a decline. This is consistent with projections of limited expansion and restoration of consumer confidence after the recall. This will hold true if the incidence rate for egg-borne SE remains constant or declines and there is no further negative publicity. A constant price for shell eggs (accepting traditional seasonality) would result in decreased margins for 2011 since most respondents forecast an escalation in feed cost. The responses suggest either unchanged or increased prices for branded, cage-free and organic eggs in 2011, although it is noted that these categories represent only about 10% of U.S. shell egg production. Egg liquid and export markets were not expected to generate any additional unit revenue for the coming year.

Egg Industry thanks producers who responded to the survey. The greater the level of participation, the more valuable is the data derived and interpretations. Suggestions regarding

the structure and topics for the 2011 survey are welcome.