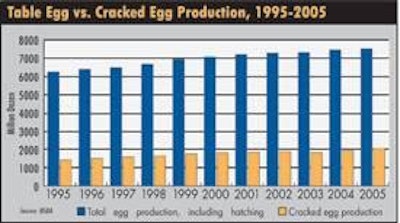

Nearly one-third of U.S. table eggs are sold as cracked eggs or processed, and that could reach 40% to 50% in the years ahead, experts say, as consumers continue to eat more of their eggs in processed form.

“In 15 to 20 years, we’ll be 50-50 (fresh eggs vs. processed),” says Marcus Rust, an owner of Rose Acre Farms, Seymour, Ind. Reasons why, he says, will be the continued growth of breakfasts from the fast food industry, and new products developed by food companies. One key factor in the growth of processed eggs reaching 32% of use in 2005 from 27% in 1995 has been McDonald’s breakfasts, Rust says, and now other fast food chains are doing the same.

In further potential good news for egg consumption, McDonald’s announced in late September that it is considering selling its breakfast menu all day long (see article in Industry News), following the implementation of a new restaurant operating system that would make the food preparation process more transparent and allow for more variety. Other fast food chains are ratcheting up their breakfast offerings as well. Wendy’s has recently introduced a breakfast menu, and Jack in the Box has begun serving its full breakfast menu all day. Rust says of McDonald’s: “breakfast is what they make their money on.”

Starbucks Serving Up Eggs

Additional proof of the boom in morning egg sales is coffee giant Starbucks’ recent entree into the market with a product designed to be a premium quality warmed breakfast sandwich, according to a source within the company. Such items have proven popular among customers in the five markets in which they have been introduced—600 of the 5,500 company-operated U.S. stores. The options include: egg, sausage, and cheddar cheese; peppered bacon, egg and cheddar; Egg Florentine with baby spinach; Black Forest ham, egg, and cheddar, and one non-egg item, reduced fat turkey bacon. The company has removed the Egg Florentine option temporarily due to the recent spinach recall.

The breakfast items were successfully tested in Seattle, offered in Washington, D.C., early last year, and rolled out in Portland, Ore., San Francisco, and Chicago in 2006. Based on the product’s success in those markets, it will likely add additional markets, the Starbucks official says. Starbucks’ entree “will sell more eggs,” Rust says, “this is great news.”

Toby Catherman, vice president, procurement, Michael Foods, Minnetonka, Minn., the nation’s largest producer of processed egg products, expects “processed eggs to show a slow creep up to 40% of the market over the next 10 years.” The big growth in processed egg use will come from new products, he says. Catherman adds, however, that while processed egg products are increasing, consumption of them is not increasing at the rate statistics suggest, because U.S. exports are increasing, and nearly all exports are processed egg products.

More than Breakfast

Catherman is aware of several new products food companies plan to introduce within three years, but he is not at liberty to talk about them. One reason behind adding egg items, he says, is their relative ease of assembly. Some of these products will be targeting egg use at other parts of the day besides breakfast, where he and others see ripe for growth. The foods will offer “more convenience.” This growth will increase total per capita consumption of eggs, even though these new products “will cannibalize some” from the use of fresh eggs, he says.

Catherman also notes that food companies continue to expand their breakfast lines, such as Sarah Lee’s recent announcement that it plans to increase its offering of its Jimmy Dean line of breakfast items, which includes egg sandwiches.

He says there would have to be huge shifts per year for the processed egg share to be as high as 50%. A decade ago, he thought that could be possible by 2010, but he did not factor in consumer resistance to purchasing liquid egg products in grocery stories. “I didn’t expect that,” he says. “It will take more of a generational shift.” One additional reason why he sees further growth in processed egg products is the excellent track record the industry has on food safety, which also bodes well for exports.

40% of Market within 5 Years

Dan Meagher, vice president of business development for MoArk, St Louis, Mo., thinks that egg products will comprise 40% of all eggs consumed within five years, although it will require an education of consumers. Meagher, who was head of MoArk’s liquid egg business before it was sold to Golden Oval earlier this year, says, “the only way to get there is through product development of new consumer items.”

Some products he sees coming are finger food items for food service and school lunches. “There is only so much you can do with a breakfast sandwich,” he says. He says major egg industry players are investing R & D in new products. Meagher says that a major source of additional liquid egg consumption is going to be through food service venues outside the home. Convincing people to pour liquid egg products in their own kitchens is going to be more of a challenge, he says, and will take some “creative marketing.”

But while use of processed egg products is increasing, and in turn will increase total egg consumption, not all is good news for liquid egg producers, Meagher says. He notes that when dried egg whites reached $6 to $7 per pound in 2003-05, a number of food companies altered their recipes with non-egg substitutes, changed their labels, and it’s going to be tough to convince them to switch back, even if eggs are better ingredients. Eggs offer functionality for a variety of food products but must “have good value,” he says.

Rose Acre’s Rust says another area where the processed egg industry has lost sales is shelf stable products, because large global food companies have sometimes switched to less costly alternatives, even if taste is lost. “It’s happening as we speak.” He doesn’t want to specifically mention the products, but “they are center isle products in grocery stores—shelf stable products, canned and baked products in jars.” In addition, Rust says, some companies are taking out eggs of products in which eggs are only a minor ingredient that some people have allergic reactions to, so they don’t have to list eggs on the label. Such products include baked goods, noodles, and dressings.

Removing the Stigma

One area Meagher sees for the industry to work on and be more innovative in is microwaveable entrees. “The market has to be viewed as snacks, for lunch, dinner.” But to move the consumption needle in a big way, “we have to remove the stigma that eggs are bad for you. We have to communicate that eggs are nothing to worry about.”

In the future, egg opportunities may exist in unlikely areas. The industry can take a lesson from the pages of the juice industry, Meagher says. “Look at the line-up of juices,” he says, each with different health benefits, such as vitamin D. “This is an opportunity for the egg industry to boost per capita consumption of liquid eggs and thus eggs overall,” although, he acknowledges, “it would not be an inexpensive proposal.”