Although home to a poultry industry for a half-century, the rise of Brazilian poultry meat production has been most dramatic over the past 12 years. Fifty-two percent of the world's poultry production is accounted for by just three countries -- the U.S., China and Brazil, with the latter now accounting for 15 percent of the total.

In 2000, Brazil produced just 6 million tons of poultry meat, but by last year this figure had more than doubled to 12.6 million tons. But this has not been growth at any cost and, according to the executive president of the Brazilian Poultry Association (Ubabef), Francisco Turra, it has been achieved "respecting the values that represent us: quality, health and sustainability."

Brazilian poultry meat, egg consumption

Today, the average Brazilian consumes 45 kg of poultry meat each year and 162 eggs. Just as there has been a dramatic increase in poultry production, so there has been in consumption, and at the start of the century, per capita annual consumption stood at only 30 kg for poultry meat and 130 units for eggs.

So why are Brazilians consuming more poultry meat now than they were a little over a decade ago?

According to Ubabef's Adriano Zerbini: "We are more competitive than the average (meat) producer, and chicken is easily affordable. Forty-five kg of poultry meat is consumed annually not necessarily because it is the meat of choice, but because it is so easily accessible, as well as being of high quality."

As far as eggs are concerned, significant growth in the sector took place some time ago. However, this century has seen total egg production increase from 1.2 million to 1.9 million tons. Yet increasing consumption further still requires some work. For example, there is no strong tradition in Brazil of eating eggs for breakfast, as is the case in some North American and European countries. However, as incomes rise, eggs and egg product consumption is expected to rise accordingly, and the Brazilian Egg Institute is working to increase public awareness of the benefits of the product.

Integrated approach to poultry farming

Brazil's broiler production is completely integrated and, unlike some countries, there are no live markets. Integration is seen as the "spinal column" of the industry: the partnering of the industry - which supplies day-old chicks, compound feed, vaccines, veterinary support, and owns the processing plants - with the small integrated producers, who are responsible for the housing and growing the birds.

According to Ubabef, the smallest poultry houses in Brazil have the capacity to hold 10,000-15,000 birds, while the biggest can hold 25,000-30,000 birds, but there are some producers who operate a variety of house sizes. In Brazil, a producer with only 10 houses in total would be considered small.

This integrated approach allows the industry to better control quality and risk. Detailed standards for poultry houses have been laid down by the Ministry of Agriculture, and lines of credit are offered for their construction. Additionally, the approach has created thousands of jobs in rural areas.

According to Zerbini, this approach ties small farmers into the global market. "These small producers know, and they are proud of the fact, that their chickens are consumed at the dining table of Japan and the Middle East," he says.

Brazilian poultry exports

Together, Brazil and the U.S. account for 69 percent of the world's poultry meat exports, the former having captured a 38 percent market share and the latter 31 percent.

Twenty-eight Brazilian companies export poultry meat to more than 150 countries, while four companies export eggs.

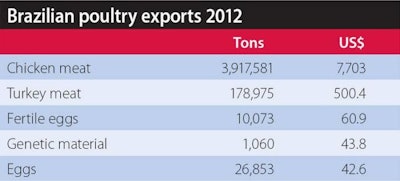

In 2000, the country's participation in the international market stood at 916,000 tons of chicken meat. By 2012, however, this had grown to close to 4 million tons of chicken meat, 180,000 tons of turkey meat, and 27,000 tons of eggs, as well as fertile eggs and genetic material. By volume, exports have grown on average by 15 percent each year, while by value the annual increase has been 25 percent.

As far as chicken is concerned, 55 percent is exported as pieces and cuts, 36 percent leaves the country as whole birds, 5 percent is sold as processed products, while 4 percent is exported in salted form.

"Exports have played a highly important role in Brazilian poultry production, but the national market is still the most important for us," said Zerbini, and Ubabef estimates that 89 percent of the chicken that is consumed globally is produced locally, with only 11 percent coming from imports.

For Brazil, the main export destination is Saudi Arabia, accounting for 16 percent of the total, and worth US$1.2 billion in 2012. Brazil is the biggest producer and exporter of halal poultry meat in the world, due in part to a long association with Muslim countries stretching back some 40 years.

Safety, health and sustainability

Despite the home market remaining the most important, the poultry industry has been developed to also be as attractive as possible to overseas customers. For example, it is governed by strict rules covering quality, safety, health and welfare, and operates a labeling system allowing complete traceability.

"Our health authorities have also learned through contact with their counterparts," Zerbini said. "Because of this, our health system is strong -- we are open to innovations."

Within the national market, there are various government/industry control programs including for animal health (PNSA), residue and contaminants control (PNCRC), pathogen reduction (PRP), and the prevention and control of added water (PPCAAP).

The sector is quick to emphasize that it operates in the south and southeast of the country -- far from the Amazon. And being a tropical country, local poultry production requires less electricity than may be the case in other countries as there is no need to heat poultry houses. Additionally, water is abundant.

According to Wesley Batista, CEO of JBS: "Brazil has a natural competitiveness, as it has land, water, a good climate and people who will work." Additionally, it has a plentiful supply of grains, is integrated, has a high health status, and benefits from continual investment. Together, these various factors make it well placed to respond to the increased demand expected for chicken meat over the next decade.

Challenges to overcome

Not everything in Brazil is ideal for poultry production, however, and the country needs to resolve serious logistical problems.

"Our sector is well aware of the serious logistical problems; however, we are convinced that these issues will be resolved," Turra said. "The federal government is conscious that it cannot solve these problems alone, and has realized that it needs to partner with the private sector to overcome them."

Yet this is not the only concern facing the poultry industry. The country is gradually losing its competitive advantage and its labor costs are increasing. Fifteen years ago, Brazilian production costs were only 60 percent of those of the USA, but this is no longer the case. Additionally, the country has lagged behind in entering trade blocs, and this may have reduced its access to some markets.