Robots in the U.S. poultry processing industry are not being adopted at the same rate as many other industrial sectors. Why are U.S. poultry producers standing on the sidelines while robotics is being more widely adopted in many other industries, including Europe’s poultry industries?

CEOs across most industrial sectors around the world see robotics in the workplace as shaping business in positive ways, according to a PricewaterhouseCoopers survey (CEO Pulse on robotics) conducted earlier in 2015. Key survey findings include:

- Robotics are cost effective and productive, with up to 94 percent of those CEOs who have already adopted robotics claiming that it has increased productivity in their business.

- Over the next five years, CEOs expect almost a fifth of their workforces will have an element of robotics to them.

- 58 percent of those CEOs intend to reduce employee headcount because of robotics.

- 64 percent of the CEOs are confident that robotics will bring new innovations to their business models.

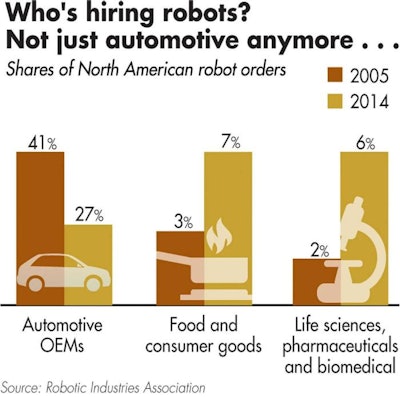

Robots, in fact, are landing new jobs in new U.S. industries. While the automotive and electronics sectors have for some time led the way in investment in robotics in the workplace, food and life sciences companies are beginning to increase their adoption of robotic technology.

Automotive manufacturers in North America, for example, placed 41 percent of the orders for industrial robots in 2005, but their share of orders dropped to 27 percent in 2014, according to the Robotic Industries Association. That is in part because food and consumer goods companies increased their share of orders for robots from 3 percent to 7 percent in the same time period. In the meantime, life sciences companies saw a similar uptick in purchases of robots during the period – up from 2 percent to 6 percent.

Food and consumer goods and life sciences companies are increasingly purchasing robotic technologies to assist with production and processing tasks.

U.S. poultry's reluctance to invest in robotics

The U.S. poultry industry, however, has not invested in a significant way in robotics and is still stuck in neutral when it comes to the adoption of robotics in chicken production and processing. Where other industries are beginning to increase their usage of robots, the U.S. poultry industry uses robots to stack and de-stack chick trays in a few hatcheries and palletize cases of poultry products in some processing plants, but sparingly.

According to a roundtable of U.S. poultry industry producers and allied industry experts at the 2015 Poultry Processing Workshop, the negligible adoption of the robotics in the poultry sector is for a number of reasons, including the following:

- Payback is not rapid enough – U.S. poultry production companies often demand payback of investment in equipment in one year or less. Paybacks for robotic investments tend to be 1.5 to 2 years, according to the roundtable participants.

- Space in processing facilities is in short supply, and while robotics does not require extensive space in the plant, the space is allocated based on quickest payback. Robotics does not have the quickest payback compared to other poultry processing equipment investments.

- Cultural issues and other concerns in the poultry industry play a role – management is reluctant to supplant human workers where robotics is unproven in their plants. Concerns include the possibility of processing line shutdowns when robotic technology fails.

Where robotics might be applied in poultry

Robotics technology exists today to accomplish many tasks in poultry processing facilities – including processing and further processing (deboning of poultry meat), packaging and palletizing. But commercial application is still a ways off for certain applications.

“The U.S. poultry industry has been slow to adopt robotics even though it has been around in the automotive and other industries for a long time,” said Rick Bennett of KL Products. “Robotics solutions for the poultry processing industry are not necessarily easy but they are doable.”

The top three tasks on the wish list for robotics in poultry processing, Bennett said, are for the hanging of live poultry in shackles on slaughter lines, the rehanging of poultry carcasses on processing lines, and the mounting of chicken front halves on cones for deboning on further-processing lines.

Deboning still out of reach for U.S. poultry

For now, the three robotics applications named by Bennett remain commercially unresolved for U.S. poultry processors, as is poultry meat deboning technology, which has been researched by the Georgia Tech Research Institute (GTRI). GTRI has been working on automated deboning, or intelligent deboning systems, for more than two years.

“U.S. poultry producers won’t be able to buy an intelligent deboning system tomorrow,” said Doug Britton, manager of GTRI’s Agricultural Technology Research Program. “It’s going to take significant investment to make it ready for a poultry processing plant.”

Researchers at GTRI are working with 3-D cameras to capture the outside geometry of chicken carcasses to help map the internal bone structure. Force and tactile sensor technology is also being used with cutting blades in the attempt to achieve meat yields comparable with manual deboning.

While automated deboning solutions are being used commercially in the European poultry industry, available applications do not yet meet the needs for yield in the U.S. market.

Europe is also ahead of the U.S. in application of off-the-shelf robotics, which might be applied now in the U.S. poultry industry. One reason for the earlier adoption in Europe is the faster line speeds. This helps spread the cost of the technology over more pounds of processed meat.

“The Europeans have done an excellent job of driving robotic innovation,” Britton explained. “They put up government dollars for institutional research in Denmark, Sweden, Holland and Germany. They invested millions of dollars into researching robotic technologies. Whereas in the U.S., the research effort has fallen to a few research universities and industry.”

Nonetheless, Britton is optimistic about the future of robotics technology in the U.S. for several reasons. For example, he believes there will be new emerging robotics technologies tested in business segments, such as life sciences and biomedical sectors, with higher margins.

As research boundaries in the medical field are pushed forward, there will be benefits in the food industry,” he said. “The medical industry has the money to pay for research and robotic systems that can be readily transferred to the poultry industry. For example, there are similar tasks in medical robots and the poultry processing – cutting tissues, tendons and bones.”

As learning robots as developed and with greater capabilities, he noted, technology will be developed that allows human poultry deboning operators to train the robots.

“Because the poultry industry will be able to repurpose those advanced robotics, a line employee will be able to train the robot. They might be able to perform a task 10 times in order to teach the robot. That’s very different than needing to develop the programming to accomplish the tasks needs to produce all the products.”

Robotic live hanging of birds doable

With imaging and sensory technology growing in capability and dropping in cost, building robotics to hang live birds on poultry slaughter lines or pick poultry parts from a tote is nearer to commercial realization than ever. For now, robotic sensing systems are challenged to grab a chicken wing out of a tub of wings. Or to grasp a live bird from a conveyor belt and hang it on a shackle. But researchers are working on new paradigms that would make these tasks commercially feasible. These applications could conceivably one day involve cobots – robots that work alongside humans. Humans might, for example, orient live chickens on a conveyor belt to allow the cobot to grasp and hang the birds.

Robotics available now for poultry processing

For now, the entry points for the adoption of robotics in poultry processing are more mundane but still deliver a payback. These include tasks such as placing bagged poultry products in a box and sealing the box and palletizing cases. Even these applications, however, are slow to be adopted.

“I work with companies that have been considering investing in palletization for three years,” Bennett said. “The hesitancy is not only cost and payback; there’s the whole idea of adopting robotics.”

“Palletizing has a two-year payback, but there are other cost benefits that are not easily factored into a payback calculation,” he explained. “For example, the adoption of robotic palletizing eliminates the exposure of workers to back injuries or other health and safety risks. Plus, the robot never takes a break or a day off.”

Robotic adoption in poultry industry

“The door is wide open for the adoption of robotics in the poultry industry,” Bennett said. “Some barriers exist that involve cost and space in the processing facility, but there are also cultural factors involving the humanistic-versus-robotic aspects. While we aren’t going to flip a switch and see robotics widely adopted in the poultry industry tomorrow, it is a matter of aligning the people, talents and technologies at the right time and place.”