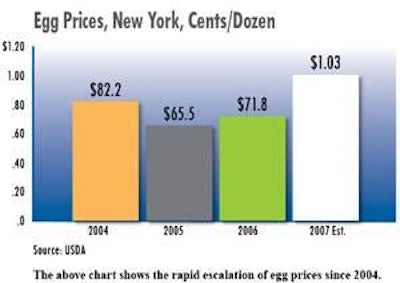

What a year for egg prices: they started the year strong, and didn't let up. For example, in late September, the Urner Barry large Midwest price quote was $1.34 per dozen, almost double the 70 cent price of September 2006.

Will 2007 prices be the strongest ever? "I believe that will be the case," says Gene Gregory, president and CEO of United Egg Producers, Atlanta. Prices were also strong in 2003-04, but the run-up then started late and didn't run as long, he states.

"This will be a very good, profitable year, one of the best we've ever had, but I won't say most profitable because grain prices have been so high," he adds, due to the ethanol boom.

In the past, producers have generally expanded when prices got high to curtail high prices, but not this time around. Reasons that prices have stayed so high during the summer, says Gregory, include:

- High costs of producing eggs due to high grain prices;

- Compliance with UEP's animal welfare program by more producers, which has kept numbers in check;

- This summer's heat, which has affected production and egg size;

- The considerably reduced inventory of dried eggs; and,

- Strong exports throughout 2007.

Gregory says that historically, when producers have a good, profitable year, they make long-term investments in new buildings, "but as a result of questions about bans on caged production on both federal and state levels, producers have delayed expansion decisions."

When asked by producers about the future of caged production, Gregory says he is "optimistic we will win the battle."

Looking at the rest of 2007, Gregory predicts that the fourth quarter "will be very profitable." Longer term, what concerns him is the percent increase in pullets hatched that could result in increases in flock numbers.

Steady Demand

Craig Willardson, president and CEO of Moark, LLC, Chesterfield, Mo., says that "discipline, balance, steady demand, and of course, the normal cyclical factors following a very poor market period starting in mid-2004" have helped keep prices strong in 2007.

The industry has been better able to manage its production and its inventories, he says, and trades of surplus product are finding the right market homes. In addition, Willardson says, customer demand has been surprisingly steady in spite of these high prices.

"It helps that all proteins and dairy products are commanding higher prices from consumers at the same time." And, he adds that increasing worldwide demand has made a difference. In addition, "unbridled expansion has not been the norm this year with the uncertainty over animal welfare issues and hopefully, some long memories of the response in 2004."

Grain Prices Keep Industry on Edge

Larry Seger, president of Wabash Valley Produce Inc., Dubois, Ind., says a combination of factors has kept prices strong. One of the biggest that has kept supplies below year-earlier levels, he says, is the spike up in grain prices "that keeps our industry on edge."

He also notes that the egg drier business has used up any inventory built up in 2005 and 2006. In addition, Seger says, the 100-degree days in July and August caused both high mortality and poor quality eggs.

Seger, chairman of United States Egg Marketers, also says that lower supplies occurred at a time when exports of both shell eggs and egg products were increasing, particularly to Europe and the Mideast. These exports were due inpart to high global grain prices perhaps making it better to import the finished product rather than grain. He adds that domestic demand "is as strong as it's ever been." He also agrees that keeping up with animal welfare guidelines has kept supplies lower.

"We will increase supplies ever so slightly as we lead into 2008," says Seger.

Paul Sauder, president of R.W. Sauder Inc., Lititz, Pa., says that one key factor keeping production in check in 2007 is that "we've been though two of the most difficult years from an economic standpoint, which has curtailed expansion." He notes that demand for eggs is good, and that all foods have increased in price. Uncertainty on the animal welfare front "is a factor," he adds. In terms of profitability, he says, "You'd have to go to at least the 1980s to find a year as profitable."

Industry Learning Not to Overproduce

Mark Oldenkamp, vice president, northwest operations for Valley Fresh Foods, Woodburn, Ore., says, "The industry is learning not to overproduce." He adds that high feed costs have encouraged producers to eliminate marginal birds from production, and has discouraged expansion.

Oldenkamp adds that uncertainty about animal welfare has constrained producers from expanding. He says, however, "I don't see cages going away and I don't think they should." But that said, cage-free demand and production are increasing, he adds.

Unsettled Time

According to Marcus Rust, an owner of Rose Acre Farms, Seymour, Ind., producers are not expanding because they are facing such an unsettled time. For example, he says, animal rights activists with a vegan agenda are trying to put producers out of business and producers are battling avian influenza, salmonella, labor issues, and air quality issues, so expansion is not on the immediate radar.

.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)

.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)