For the Brazilian pig industry, stable production levels and a strong recovery in prices made 2010 a profitable year.

While there was only a moderate increase in production, demand for pig meat from Brazilian consumers expanded “robustly.” Alongside this, prices both at home and overseas increased, and there was a lower supply of beef. Less favorable to Brazilian pig producers, however, is the strength of the country’s currency (the Real) and increased competition in the international market.

Steady but strong

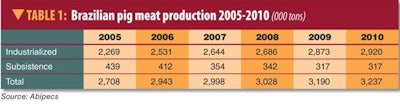

Brazil produced 1.5% more pig meat in 2010, when compared with 2009, with output rising from 3.19 million tons to 3.24 million. Part of this expansion was the result of a 3.5% increase in average slaughter weights over the year, reports industry association Abipecs.

By head, the supply of pigs going to slaughter remained relatively stable, increasing 1.8% from 33.8 million head to 34.3 million. The breeding herd also remained constant at 2.46 million head. While 2010 recorded a small increase in pig numbers, Abipecs attributes this to the ongoing world economic crisis, which has reduced investment.

The number of pigs slaughtered under the Federal Inspection scheme stood at 29.1 million head last year – an increase of 2.5% in comparison with 2009. In contrast, the number of animals slaughtered under other inspection schemes continued to decline. In excess of 83% of the pig meat produced last year was sold on the home market. The ongoing growth in the number of animals slaughtered, with only stable supplies, led to a recovery in prices in Brazil.

Room for domestic growth

2010 was characterized by low stocks, a strong demand for pig meat and high prices. Demand is also thought to have increased because of reduced supplies of beef, resulting in consumers searching out alternative meats.

While the amount of pig meat for national consumption increased 4.1%, Abipecs stated that Brazilian consumers could consume more, and estimated a per capita annual consumption of 15 kg could be achieved. This suggests that there is still room for the pig industry to grow in the domestic market, as well as exports.

Export market

The financial crisis of 2008-2009 continued to affect the price and volumes of Brazil’s pig meat exports last year. While there was a significant price recovery in 2010 — an increase of 23.3% compared with 2009 — exports remained at levels achieved between January and October 2008.

The main factor contributing to reduced export volumes was the strength of the Brazilian currency. This weakened the competitiveness of Brazilian exports against those of its main competitors particularly the US and some European countries. Additionally, Russia, the main importer of Brazilian pig meat, introduced changes to its exchange rate that favored US and European exporters. In addition to this, the weakening of the US Dollar resulted in lower production costs for US producers in comparison to their counterparts in Brazil.

For almost all sectors of the 2010 Brazilian economy, the home market proved to be much more attractive than the export market. This allowed those exporting companies to choose not to sell at the prices offered by importing countries, as they were able to sell to the domestic Brazilian market instead.